Economics Assignment Questions

Microeconomics – Worth 20% of total assessment: Answer all five (5) of the following questions. Each question is worth equal marks and will be marked out of 10. The total mark is 50 and will then be converted to a make it worth 20 percent References are only required for Question 5.

Question 1 Explain the relationship between the law of diminishing returns and the concept of economies of scale.

Question 2 Explain with the use of diagrams where appropriate how perfect competition leads to allocative productive and dynamic efficiency.

Question 3 Illustrate with the use of diagrams how the profit maximising price and output for firms in a monopolistic competitive market structure is determined. Does the fact that monopolistically competitive markets do not achieve allocative or productive efficiency mean that there is a significant loss in economic well-being to society in these markets?

Question 4 What is a natural monopoly? If a firm is a natural monopoly, illustrate with the use of diagrams why is it is necessary to have the price set by a regulatory authority rather than by the market.

Question 5 Petro prices recently plummeted, discuss some of the reasons behind this development.

Solution

Economics Assignment Answers

Question 1

Both the diminishing returns and the concept of the economies of scale have a relationship with respect to the fact that they relate to the production of goods and services. Diminishing marginal returns come into existence as a result of the increase in the input with at least one of the factors of production, such as capital or labour, holding constant. The diminishing marginal returns take place in the short-run. Returns as a result of the economies of scale result from the increase in the production input with respect to all factors of production. On the other hand, the effects of the returns due to economies of scale take place in the long-run (Hubbard, 2013).

According to the law of diminishing returns, every additional unit in at least one or two of the production factors while at least one remains constant results to the decrease in the output per unit. However, the above does not necessarily result to negative returns in the overall output. For example, a firm that hires more employees while the office space remains the same may increase the output. However, every additional employee produces additional output that is less compared to before the hiring of the new employees. On the other hand, the returns resulting to the economies of scale relates to the proportion between increasing the production inputs and the increase in the production output as a result. A decrease in the returns due to the economies of scale results when all the factors of production increase by given percentage while a less than proportional production output increase happens as a result of the same.

Question 2

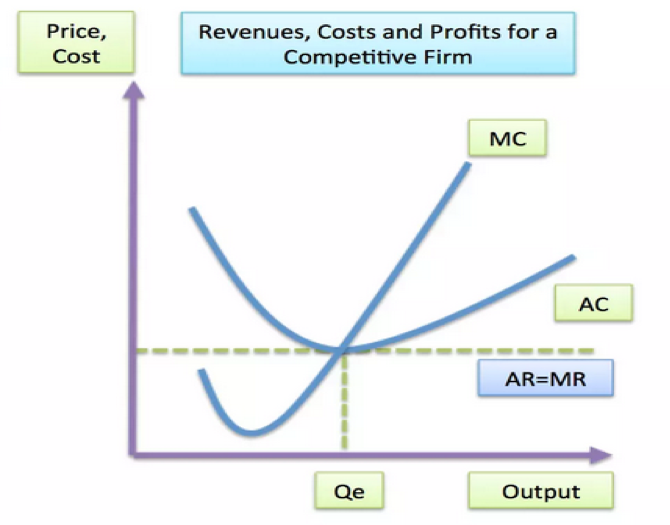

Perfect competition is quite useful as an element of comparing other market structures since it features high levels of economic efficiency (Hubbard, 2013). The usefulness of perfect competition in resulting to productive, allocative and dynamic efficiency finds its basis upon the illustration in the diagram below.

Form the above diagram, it is clear that the industry is at long-run equilibrium at P=MC therefore establishing allocative efficiency. At the same time, P=MC at the place where AC is at its minimum thus providing productive efficiency. Additionally, the industrial structure depicts static efficiency since the price seeking behavior tends to drive down the production costs and as a result removing inefficient firms from the industry.

Allocative Efficiency: Notably, the price equals the marginal cost (P=MC) both in the long as well as the short-run. The above means that there is allocative efficiency where the both the producer and the consumer surplus are maximized at the ruling price. That is, it is not possible to make one party better without making the other party worse off – Pareto Optimum.

Productive Efficiency: For there to be productive efficiency, it is necessary to supply the equilibrium output at the underlying minimum cost. It is only possible to attain the above under the long-run scenario in a perfectly competitive market. The reason for the above finds its basis upon the fact that firms that feature high costs per unit have no means to influence the market price since the forces of competition are in charge of determining the direction of the prices.

In light of the above, it is quite appropriate to conclude that perfect competition in various industries is important in the establishment of allocative, productive, as well as dynamic efficiency.

Question 3

In every monopolistic competition across various industries, each firm enjoys a given degree of authority that allows it to set the effective market prices. In a monopolistic market, the price of a product depends upon factors such as the demand, the cost function, and certain regulations by the government, as well as the objective of the product (Economics Online, 2016).

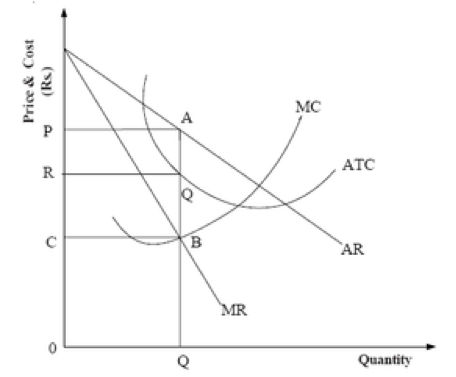

In the short-run, a monopolistic firm may, or may not, earn any profits. The illustration below shows a monopolistic firm that is earning economic profits.

Notably, the short-run equilibrium for the firm in the above diagram is at quantity Q and price P – at point A. At point A, the area under PAQR represents the economic profit. There exists a difference between the above and the case of a monopoly in the sense that the entry barriers are still low here and thus new firms can still find an easy way to enter – and they can continue entering for as long as they make profits.

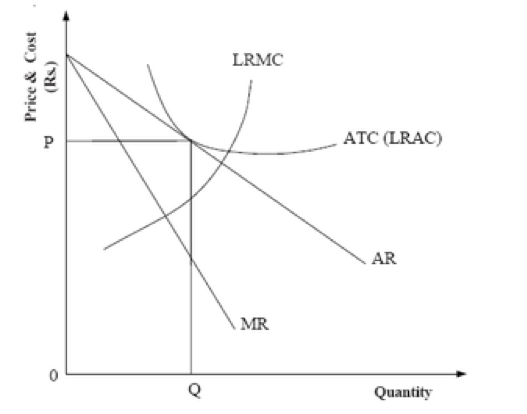

On the other hand, the long-run outcome is relatively different. Notably, the long-run decision closely resembles that in the perfect competition. The diagram below helps in illustrating the long-run price determination in a monopoly.

From the figure above, it is clear that LRAC and LRMC stand out as the long-run average cost curve and the average marginal cost curve, respectively. Using a hypothetical monopolistic firm that is making quite substantial economic profits, the demand curve (AR) continues to shift downwards to the point where it becomes tangent to LRAC. With such equilibrium, losses come with either an increase or a decrease in the market price. Consequently, new firms stop entering leaving the established firms to enjoy monopolistic control.

Question 4

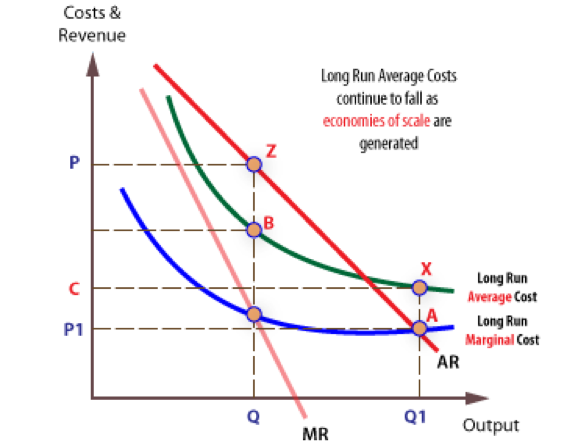

A natural monopoly refers to a distinct type of monopolistic competitors that arise in markets characterized by highly fixed distribution costs. Notably, natural monopolies exist especially with the supply of large-scale infrastructure. The best example so natural monopolies include the supply of infrastructure such as electricity grids and cables, water and gas supply pipelines, as well as networks for rails and other national transportation infrastructure. In the case of a natural monopoly, the pursuit of completion increment by way of encouraging new entrants only promotes losses as well as reduces the overall efficiency in the market (Economics Online, 2015).

In light of the above, utility companies are the ones that feature mostly as natural monopolies. The reason for the above finds its basis upon the fact utility companies require extensively expensive infrastructure required in the delivery of public utility goods that are vital for the citizens – including water, gas and electricity, among others.

In some cases, such as in the United Kingdom, public utilities are privately owned. Consequently, they must operate under special regulatory authorities. The regulatory bodies ensure that the natural monopolies do not use their monopoly status to exploit others. Ideally, the regulators apply price caps or define the extent of the possible returns allowed to the public utilities. The diagram below shows what would happen if there was no regulator for natural monopolies.

From the diagram above, it is clear that for a natural monopoly, the average total cost curve (ATC) keeps falling. The reason for the above is the existence of continuous economies of scale. Consequently, the marginal cost (MC) is always below the ATC meaning that without the interference of a regulator, a natural monopoly stands a position to make supernormal profits for as long as they continue with their operations (Economics Online, 2015).

Question 5

Over the last couple of years, the prices of oil have been on a gradual downward trend. It is quite a paradox since the price of finding more oil continues to rise (Krauss, 2016). In light of the above, the most possible reasons behind the plummeting of the oil prices includes among the following.

First, there is the oil boom in the United States. The production of shale oil in the United States has experienced substantial growth since the year 2008. Additionally, the United States halved its import of crude oil from OPEC. For the first time since thirty years ago, the United States stopped its crude oil business with Nigeria (Pedersen, 2014).

The other reason is coming back of Libya in the oil production business (Pedersen, 2014). After the stability following the long internal strife in the above oil rich country, now the country is producing an average of quart million barrels of oil per day – which increases the supply of the oil in the global market.

Additionally, there have been cases of infighting

between the member states of OPEC. Notably, the Kuwaitis and the Saudis have

recently been in an oil war in the pursuit of each trying to maintain its

dominance in Asia. In light of the above, price reduction has been a workable

way through which each OPEC member uses to secretly maintain its respective

market share (Pedersen, 2014). The

consequences of the United States cutting down on its crude oil import and the

coming back of Libya have increased the supply of oil in a major way. Coupling

the above with the infighting in OPEC, the natural law of demand and supply

have as a result taken place and promoted the plummeting of the petrol prices

as observed in the recent past.

References

Economics Online,. (2015). Natural Monopolies. Economics Online. Retrieved 2 February 2016, from http://www.economicsonline.co.uk/Business_economics/Natural_monopolies.html

Economics Online,. (2016). Monopolistic Competition. Economics Online. Retrieved 2 February 2016, from http://www.economicsonline.co.uk/Business_economics/Monopolistic_competition.html

Hubbard, R. (2013). Essentials of Economics. French’s Forest, N.S.W.: Pearson.

Krauss, C. (2016). Oil Prices: What’s Behind the Drop? Simple Economics. New York Times. Retrieved 2 February 2016, from http://www.nytimes.com/interactive/2016/business/energy-environment/oil-prices.html?_r=1

Pedersen, C. (2014). 5 Reasons Oil Prices Are Dropping. Oil Price. Retrieved 2 February 2016, from http://oilprice.com/Energy/Oil-Prices/5-Reasons-Oil-Prices-Are-Dropping.html