Managerial Economics

Instructions:-

Managerial Economics Essay.

Question 1

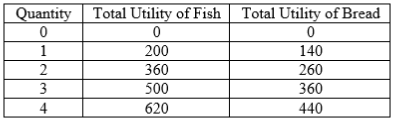

(a) You have decided to spend $40 this month on Fish and Bread. The total utility you receive from different quantities of fish and bread are shown in the table below. The prices of fish and bread are both $10 per unit.

Apply the rational spending rule to determine the combination of Fish and Bread that optimises your total utility. Explain why applying the rational spending rule is a more appropriate decision making tool for optimizing consumption, compared to simply evaluating the total utility of different bundles of goods.

(10 marks)

(b) A large pharmaceutical company estimates that the demand function for its medicine is P = 60 – 5Q. It is currently selling the medicine at $40 per unit.

(i) Calculate the price elasticity of demand at this price.

(5 marks)

(ii) Do you think it is a good idea for the company to raise its price to earn more revenue? Explain your answer using the relevant elasticity concepts without reference to graphs or equations.

(5 marks)

(iii) At what price does the company maximise its revenue? Show your work.

(5 marks)

Question 2

Consider a monopolist producer who faces a linear demand curve P = 24 – Q, where P is the price the producer charges and Q is the quantity consumers purchase. The producer produces this good at a constant average and marginal cost of $6.

(a) Identify the price and quantity if the monopolist wishes to maximise revenue.

(5 marks)

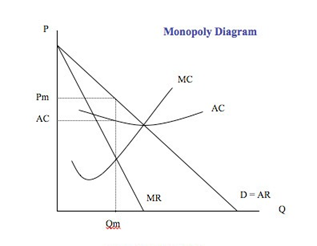

(b) Identify the price and quantity if the monopolist wishes to maximise profits. Support your answer with a diagram.

(10 marks)

(c) Suppose the government imposes a tax of T dollars per unit on the producer. By how much will the consumer shoulder the tax burden? By how much will the producer shoulder the tax burden? Explain why, in general, the consumer shoulders part of a tax burden even when the tax is imposed directly on the producer.

(10 marks)

Solution

Managerial Economics Assignment Help.

Managerial Economics Essay

(a)

| Quantity of fish | Utility | Cost in $ | Quantity of bread | Utility | cost | Total utility |

| 0 | 0 | 0 | 4 | 440 | 40 | 440 |

| 1 | 200 | 10 | 3 | 360 | 30 | 560 |

| 2 | 360 | 20 | 2 | 260 | 20 | 620 |

| 3 | 500 | 30 | 1 | 140 | 10 | 640 |

| 4 | 620 | 40 | 0 | 0 | 0 | 620 |

The optimal/best combination will be three fishes and one bread. Rational spending is a decision tool for decision making since focuses on the utility derived from the commodity rather the combination amount of the communities, in the case of the consumer in question consumption of the bread or fish is assumed to constant and both commodities are the same.

(b) A large pharmaceutical company estimates that the demand function for its medicine is P = 60 – 5Q. It is currently selling the medicine at $40 per unit.

- price elasticity of demand

(5 marks)

∆P/Q∆*Q/P=price elasticity

40=60-5Q

Q=4

Therefore

5*4/40=0.5

(ii)

The current elasticity is less than one which means the prices of the commodity is less responsive to demand. An increase in the prices of the products in the pharmaceutical company will lead to a reduction in the sells volume due to mechanics of demand and prices. Elasticity will not affect the prices of the commodities. Therefore, it is ideal for the company to raises its prices to earn more revenues.

- Maximizing the Revenue

Calculating for Total revenue (TR)= Price X Quantity

From the demand function P = 60-5Q

TR= (60-5Q) * Q= 60Q-5Q2

At maximizing point MR=MC=0

But, MR is a derivative of TR

Therefore, MR = 60- 10Q

At maximum conditions MR=0

60-10Q =0

Hence,

Q*= 6

Substituting it on the demand function we find the price (P*) to maximise revenue

P* = 60- 5(6), P* = 30,

Thus the company should charge 30 dollars per unit to maximize its revenue.

Question 2

(a)

MC=MR at point revenues is maximum.

MC=MR=P=$6

6=24-Q

Q=18 units

P=$6

(b)

The monopolist will maximize revenue at the point when the prices of the commodity are above the equilibrium value in the market. This done by the monopolist by increasing the prices infinitesimally until the maximum point is attained. From the diagram below the maximum prices is approximate $10 while the equilibrium price is $6. Qm is the equilibrium quantity while Pm is the equilibrium prices in the market.

(c)

P = 24 – QT will have a new demand equation in the market if everything is kept constant. If the producer bears the cost of tax, then the demand equation will remain as P = 24 – Q. In most cases, producers shift taxation to consumers by increasing prices since it is possible and the value incurred by the consumer will be less as compared to the value the producer will incur. From the new equation

P = 24 – QT

6=24-18T

T=$1

Therefore consumers will have to increase one dollar in every unit they consume as compared to the previous units they consume. Thus the consumer will bear the tax burden of $1 as while the produce will feel the incidence of the tax as the consumers feel the impact.