FIN3013 Assignment 1 Help

Instructions:-

FIN3013 Assignment

You need to show/write/explain inputs to your computations to get full credit. Upload a pdf copy to Blackboard.

Question 1 (30 points, Chapters 3 and 4):

For each of the questions below, draw the timeline and compute the present value or future value as required. Show all your work. Write the formula and show what you plugged in.

a. Present value of $5,000 received 10 years from today if the interest rate is 12% per year.

b. Future value of $10,000 received 5 years from today if left in an account until 40 years from today, when the rate of return is 10% per year.

c. Present value of $5,000 received 4 years from today and $6,000 received 20 years from today if the rate of return is 8% per year

d. Future value of the cash flows in part (c) above when evaluated 50 years from today at 8% per year.

e. Present value of an annuity of 10 payments of $1,000 each starting today at t=1 and ending at t=10 when the interest rate is 10% per year.

f. Present value of an annuity of 10 payments of $1,000 each starting today at t=0 and ending at t=9 when the interest rate is 10% per year.

g. Future value of an annuity of 10 payments of $1,000 each, starting today at t=1 and ending at t=10 when the interest rate is 10% per year and the future value is computed for t=10.

h. Future value of an annuity of 10 payments of $1,000 each, starting today at t=0 and ending at t=9 when the interest rate is 10% per year and the future value is computed for t=10.

i. Present value of an annuity of monthly payments of $100 starting 1 year from now, and lasting for 5 years (60 payments) with an APR of 6% per year with monthly compounding.

j. Present value of a growth perpetuity that starts 7 years from today, with the first payment of $1,000, a growth rate of 1% per year, and a required rate of return of 9% per year.

Question 2 (10 points, Chapter 5): Present Value/ Future Value and Mortgage Payments and Balances

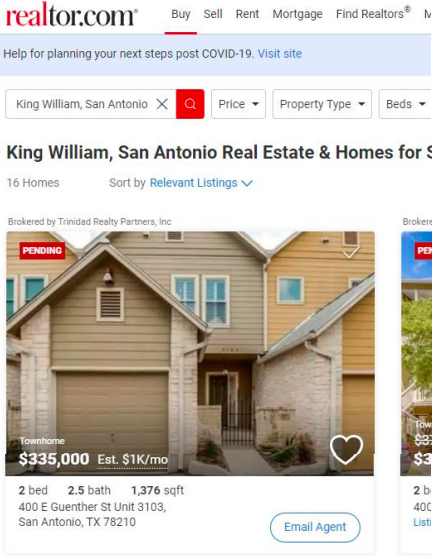

You purchase the townhome listed above at realtor.com and borrow 95% of the listed price from Broadway Bank at an APR of 6% with monthly payments (your down payment is 5% of listed price). The maturity of your mortgage equals 30 years with monthly payments.

a. Draw a time line that depicts the cash flows from the mortgage payments- compute the payment and show your inputs and work.

b. Compute the outstanding mortgage amount after you have made 15 years of payments.

i. Show this point on the time line, and

ii. give the inputs to your computations for full credit.

c. What is the interest and principal component of the next mortgage payment after making payments for: 5 years, 15 years and 25 years.

Question 3 (10 points, Chapter 5): Term Structure and Cost of Capital

Draw the current term structure of interest rates (as of today). Label both the axes and the points on the curve. You can get this information from Bloomberg.com.

Also include the term structure in early 1980s and early 1990s. You can get this information from the web or from your book.

Explain in less than 10 lines –

- What does the current term structure, as you have graphed, imply for the future path of future interest rates?

- What causes the future change in rates in your opinion?

- Why was the term structure different in the 1980s?

- Why is the term structure important for valuing financial asset prices?