Instructions: You are required to produce the following parts of a report on bilateral exchange rate of your choice.

SECTION A – 50%:

A) Briefly describe and explain the movement in the bilateral exchange rate of your choice between January 1st 2015 and December 31st 2015 (e.g. GBP/USD or USD/JPY).

B) Using any of the theories of exchange rate determination discussed in AC4202 (for example, purchasing power parity), what would the predicted exchange rate changes have been over this period? Choose the frequency or frequencies you think appropriate (e.g. monthly, annually). Use diagrams and/or tables to illustrate your answer.

C) Briefly outline reasons why the theory or theories that you selected were (or were not) effective in forecasting your chosen bilateral exchange rate.

SECTION B – 50%:

The Report:

Your company has the opportunity to invest in the setting up of a new Gold mine in Brazil.

You have been asked to prepare a risk assessment of the project based on the below structure.

You are to 1) Identify a number of significant risks.

2) Explain the frequency and severity of each risk.

3) Explain how each risk could be managed most effectively. Only discuss risks which you believe are material to the company’s decision. In your conclusion you are also asked to recommend whether to invest or not invest in the new mine based on your prior discussion.

Solution.

Introduction

The foreign-exchange rate determines the worth of or the rate at which the currency of one nation should be exchanged for another currency. According to Evans (2011), the process plays a critical role in influencing global economics and in the control and management of financial risks. The foreign exchange market determines the exchange rates by creating an open platform for buyers and sellers to trade currencies constantly. However, several factors influence the exchange rates. These factors include inflation rates, balance of payments, and interest rates among others, which impact on global economics majorly. As Piersanti (2012) asserts, the purchasing power parity theory (PPP) and the interest rate parity theory focus on the explanation of the influence of the various factors and their impacts on bilateral and the general exchange rate. This report outlines discusses the movement in the bilateral US Dollar (USD) and Japanese Yen (JPY) exchange rate between January 1st and December 31st 2015. It integrates the PPP theory to predict exchange rate changes in relation to the bilateral exchange rate and offers a succinct explanation of the effectiveness of the theory in the forecasting.

The Bilateral USD/JPY Exchange Rate

In 2015, the bilateral USD/JPY exchange rate from January to June of 2015 recorded a decreasing monthly exchange rate. The trend was caused by the continued strengthening of the US Dollar. The increasing value of the USD meant that 1JPY would purchase less USD. The bilateral USD/JPY exchange rate was influenced by different factors that affected the value of the currencies. Factors such as the interest rate differential between BOJ (the Bank of Japan) and the Federal Reserve affected the value of the currencies in relation to each. For instance, the strengthening USD could be attributed to the intervention of the Federal Reserve in open market activities focus on strengthening it. The effect was the increasing value of the USD/JPY as the dollar strengthened against the Yen. However, the trend changed from July to October where the rate started increasing depicting the strengthening of the JPY against the USD. The intervention of the BOJ played an important role in the process (X-RATES, 2015).

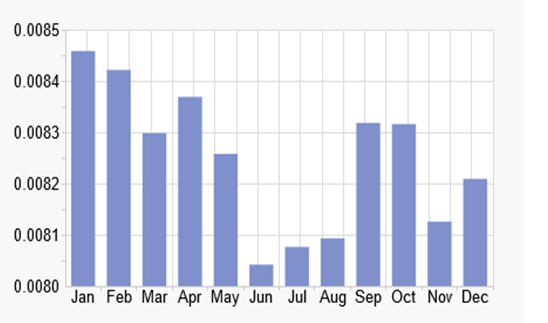

The table below shows the average monthly bilateral exchange rate of JPY to USD from January to end of December 2015.

| Month | Average Monthly Exchange Rate |

| January | 0.008452 |

| February | 0.008419 |

| March | 0.008309 |

| April | 0.008372 |

| May | 0.008272 |

| June | 0.008079 |

| July | 0.008110 |

| August | 0.008125 |

| September | 0.008326 |

| October | 0.008324 |

| November | 0.008154 |

| December | 0.008229 |

(X-RATES, 2015)

According to (Sarno & Taylor, 2002), “the purchasing power parity (PPP) exchange rate is the exchange rate between two currencies that would equate the two relevant national price levels if expressed in a common currency at that rate, so that the purchasing power of a unit of one currency would be the same in both economies.” The PPP exchange rate theory influences the microeconomics of the countries involved significantly. Young Hook (2010) asserts that the PPP theory argues that goods in one of the countries engaged in the bilateral exchange should cost the same amount amount in the other country upon a consideration of exchange rates. The application of the theory plays a significant role in the determination of the rates of exchange. However, its most important role is the determination of future exchange rates through an effective forecasting. Therefore, even when the theory has its weaknesses, its strengths impact the forecasting process and thus influences the process of financial risk control and management across the bridge (Piersanti, 2012).

The application of the theory proves effective in forecasting. According to (Sarno & Taylor, 2002), the PPP theory is effective in forecasting future exchange rates. It stipulates that ER change between two currencies is greatly determined by the relative price levels in the two countries. The determination of the future ER, according to the theory, is achieved by singling out the changes in price levels and application of the changes as determinants of the ER movements. Therefore, following the influence of the relative price levels, Baumol and Blinder (2009) asserts that the PPP theory, also the inflation theory of ER, is critical in the determination and prediction of the future ER. The PPP theory plays an important role in the explanation of the behaviour of the exchange value of a currency. The changes recorded in the relative price levels across a nation, as the theory posits, determine the long-term ER changes (Carbaugh, 2009; Baumol & Blinder, 2009). For example, according to the PPP theory, the value of a currency would depreciate by an equal amount to the domestic inflation excess over the foreign inflation. Additionally, the appreciation of the currency would be expected to equal the amount of the excess foreign inflation in relation to the domestic inflation. As such, the application of the theory allows the effective determination of the value of a currency in the long-run and thus the determination of the exchange rates (Carbaugh, 2009).

The application of the PPP theory in the determination of the exchange rates of the monthly USD/JPY ER is greatly ineffective. It would be difficult to determine the value of the currencies using the theory. Most importantly, the theory is inefficient in the determination of short-term exchange rates and thus its application in the prediction of the monthly changes in exchange rates of the USD and the JPY in 2015 would be difficult. Various reasons outline the ineffectiveness of the theory in the prediction of the ER changes. Among the key reasons is that the PPP theory applies effectively on the determination or prediction of long-run changes in currency values and thus the changes in the exchange rates. Further, the theory possesses other numerous limitations that make it ineffective in the prediction of the short-run exchange rate changes of the bilateral USD/JPY exchange rate.

Though the PPP theory offers a simple model for the determination of the exchange rates and for an effective understanding of various economic phenomena, it was ineffective in the prediction of the ER changes of the USD/JPY between January and December 2015. The application of the theory only works effectively when predicting and determining long-term trends such as the depreciation of the USD against the Japanese Yen (Borsic, Baharumshah, & Bekő, 2012; Piersanti, 2012). Additionally, it depicts effectiveness in the determination of the ER changes occurring as a result of hyperinflations. However, in the determination of the short-term changes in ER, the theory presents several limitations. For example, the PPP theory is not essentially accurate in the determination of the value of currencies. According to Carbaugh (2009) and Jiang, Bahmani-Oskooee, and Chang (2015), the application of the theory proves ineffective in the determination of the real value of currencies across different countries all the time.

The theory depends greatly on the national price levels for the determination of or prediction of the ER changes. However, it does not consider the fact that many products in the market are not easily traded (Mankiw, 2015; Korap & Aslan, 2010). The failure to put this into consideration limits the effectiveness of the PPP theory and thus its application in the prediction of changes in the ER. For instance, in the case of Japan and the US, a situation where haircuts are more expensive in the latter would make international travellers avoiding the use of the services in the country and prefer Japan for the services (Mankiw, 2015). Additionally, the higher prices in the US may prompt the movement of haircutters from Japan to the US. The application of the theory depicts ineffectiveness since the arbitrage in the case stated would be greatly limited to allow the elimination of the price differences. The deviation from the PPP may persist thus the JPY would continue buying less of the services in the US than in Japan (Mankiw, 2015).

The

application of the PPP theory was not effective in forecasting the bilateral USD/JPY

exchange rate. The theory focuses on the price levels of the different nations

to forecast the exchange rates. However, this approach is ineffective

considering that some goods are not tradable and others that are do not form

perfect substitutes for the foreign tradable products. This makes the

application of the theory of purchasing power parity ineffective in the

determination of the bilateral exchange rate. According to (Mankiw, 2015), the theory is not

an effective exchange-rate determination theory. It does not provide a

substantial explanations for understanding the exchange rates. Baumol and Blinder (2009),

Zhang and Zou (2014), and Young Wook (2010) assert that

people have incentive for the movement of products across national borders as RER

(real exchange rate) shifts from the level which the PPP predicts. The PPP provides

a real for the expectation of the RER changes but does not fix it completely.

As such, this makes it difficult to apply the PPP theory in the prediction of

the changes of the bilateral exchange rates (Mankiw, 2015). Its application in

the bilateral USD/JPY exchange rate was, therefore, faced with different limitations

making it highly unlikely to offer reliable and credible predictions.

Midway Gold Corporation – The Report

Introduction

The achievement of increased profit efficiency for mining companies demands the continued exploration and exploitation of new mines. The focus is to ensure a continuous supply of the minerals to meet the demands of the market. Companies in the gold mining sector experience extensive competition among themselves and from other mineral mining companies, especially companies dealing with precious stones (Antonil, Coates, Boxer, & Schwartz, 2012). The competition pushes companies to develop and implement effective and efficient strategies for the achievement of a competitive advantage, a greater market share, improved profitability, and the creation of shareholder wealth. Further, various risks are inevitable and thus the companies focus on the management and prevention of their risks and their implications on operations. The Midway Gold Corp. ventures in different exploration activities and the implementation of efficient corporate strategies to achieve a competitive edge and a greater market share. As an American company, the operations of Midway Corp. in different countries are influenced by different aspects, among them foreign exchange rates and other microeconomic factors. This report outlines the efforts of Midway in setting up a new gold mine in Brazil. It analyses the risks, their frequency and severity, and their effective management.

Setting Up a New Gold Mine in Brazil

The development of a new gold mine requires extensive capital for the development of the essential structures and systems, labour, exploration materials and to meet other critical financial, labour, and exploitation needs. The process poses different risks depending on the location, the gold market, foreign exchange rates, and other critical global market trends. All the processes, like in any other foreign investment, are affected by the existing macro and micro-environmental factors (Barisheff, 2013). The critical analysis of the environmental factors is critical for the identification and prevention or management of the most impactful risks. An extensive analysis of the political, environmental, social, technological, and legal-political factors is critical for the identification of the possible risks. Further, the market analysis, the competitors, and the evaluation of the strengths, opportunities, weaknesses and threats facing the company is equally important in the process (Crowther & Capaldi, 2008). In setting up a new mine in Brazil, the Midway Corp. must take into consideration all the factors and critically analyse them for the identification of the risks in order to develop efficient management strategies.

Significant Risks

In developing and operating a new mine in Brazil, the Midway Corp. faces various significant risks. These risks threaten its operations, profitability, and overall growth. Some of the risks facing the process include but are not limited to exploration risks, management, feasibility, pricing, exchange rate and political risks among others (World Magazine, 2009; Reid, 2014). The discussion of these risks forms an essential platform for the development of measures for the prevention and management of the risks to ensure sustainable operations, profitability, and growth (Antonil, Coates, Boxer, & Schwartz, 2012).

To start with, exploration risks are inevitable in the mining industries. Gold mining companies and miners face exploration risks that must be critically analyzed before the commencement or start-up of a new mine. According to (Moody, 2005) and (Damodaran, 2007), exploration risks include the possibility of the non-existence of the gold in the identified mine gold. The risk is costly and is determined after the exploitation where the company ascertains whether the product it seeks to exploit is confirmed present. The risk is one of the most impactful as it occurs after the investment of capital in the operations, which in the case of insignificant to no minerals, the capital acquires zero returns (Damodaran, 2007). However, as a major gold mining companies, the Midway Corporation diversifies its operations and mining sites to minimize the impact of the exploration risks. The impact of the risk becomes less damaging with the various and diversified exploration sites (Moody, 2005). In its start-up gold mine in Brazil, the company might experience damaging impacts if it experiences the exploration risk.

The feasibility risk is another critical risk facing the Midway Corp. in the development of a start-up gold mine in Brazil. The confirmation of the presence of minerals is important in exploration, however, the feasibility of the mine is of greater importance. According to World Magazine (2009), the determination of the feasibility of the mines is essential in the determination of the profitability and the minimization of other risks. Feasibility involves the analysis of the mines to identify any geological challenges that may limit the exploration and the profitability of the mining operations. The feasibility of a mine, for example, should consider such crucial aspects such as the mining rate and factors that influence the amount of dilution making the gold deposits unfeasible. The influence of the feasibility risk is significant on the operations of the company but does not affect profitability especially where the deposits are significant but inaccessible due to the geological conditions. The consideration of this risk by the Midway Corp. is essential for efficient decision-making and planning (Carbaugh, 2009).

Further from the aforementioned, the development of a new gold mine in Brazil presents pricing and exchange rate risks. The valuation of the stocks in the industry and the price levels of gold in the Brazilian and global market influence the pricing strategies of the company (Crowther & Capaldi, 2008; Moody, 2005). The valuation of the mining stocks allows the calculation and evaluation of the price of the gold per dollar and multiplication of the price with the market price. The pricing strategy of a mining company influences its competitiveness and profitability significantly. While operating in the Brazilian gold mining industry, the Midway Corp should set up competitive gold prices after an extensive financial and economic analysis of the market price and all the factors that influence pricing (Baumol & Blinder, 2009). The company should engage in an articulate research of the global and local market price trends. The identification of the factors that influence pricing risks creates an effective platform for the development of measures and strategies for the prevention of risks and their recurrence (Damodaran, 2007).

The management and leadership of any organization is critical for the achievement of organizational goals. Every companies strives to achieve greater profits through the acquisition of expansive market shares for its products. Effective management of mining companies determines the extent of success of the organizations. Management risks in the mining industries are higher since the operations are long-term and the realization of mismanagement within the companies can take years (Barisheff, 2013; Antonil, Coates, Boxer, & Schwartz, 2012). Mismanagement affects mining companies greatly since the operations are capital intensive. However, in the case of Midway Corp, there is little likelihood of mismanagement. The company has proved to have effective management and leadership that prioritizes its goals and objectives. The management focuses on the achievement of returns on investment to guarantee corporate development and the creation of shareholder wealth (Damodaran, 2007; Reid, 2014). Therefore, the occurrence of mismanagement risks in the operations of Midway Corp are unlikely. However, the company must set measures to ensure accountability, transparency, and efficient management.

The Frequency and Severity of Risks and their Effective Management

The frequency and the severity of the risks influence the operation of gold mining companies significantly. The most frequent and highly severe risks that the Midway Corp. may face in starting up a new gold mine in Brazil are the feasibility, exploration, and pricing risks. The feasibility and exploration risks are influenced by factors beyond the control of the company’s management. The risk is even greater in Brazil with reports of exploited mines due to centuries of gold mining. Further, the pricing risk is influenced by currency volatility, global and local market trends and pricing (Damodaran, 2007). Additionally, the influence of foreign exchange rates on the pricing of gold is significant and poses a great pricing risk. The management risk does not occur frequently but its occurrence impacts severely on the company.

The effective management of the risks requires the implementation of efficient strategies. The process of risk management starts with the identification and the assessment of the risks. The management should focus on the determination of the frequency and severity of the risks in order to set efficient measures for the prevention of the risks. The determination of extent of the exploitation of the gold mines, the geological concerns, and the issue of feasibility is important in the determination of the extent and severity of the risks (Antonil, Coates, Boxer, & Schwartz, 2012). Additionally, the analysis of the pricing and market trends is essential for the determination of the pricing risks. The application of the different exchange rate theories is essential for the determination of the currency exchange rates and the global gold prices (Baumol & Blinder, 2009). Midways should prioritize the highly prevalent risks for their effective management and alleviation of their impacts.

Conclusion

Investing

in a new gold mine in Brazil poses numerous uncertainties that may cost Midways

Corp. significantly. The company should evaluate all the possible risks in

relation to the input and the possible returns on investment. The feasibility,

exploration, and pricing risks pose a great challenge for Midways. Amidst significant

evidence of the exploitation of the mine golds in Brazil, feasibility

challenges, and uncertainty in pricing, investment in the country would be a

wrong move for the company. Therefore, Midways Corp. should not invest in the

gold mine in Brazil without the certainty of feasibility, minimal exploration

risks, and the stability in the gold pricing.

References

Antonil, A. J., Coates, T. J., Boxer, C. R., & Schwartz, S. B. (2012). Brazil at the dawn of the eighteenth century. Dartmouth, Massachussetts: Tagus Press/UMass Dartmouth.

Ayala, A., Blazsek, S., Cuñado, J., & Gil-Alana, L. A. (2016). Regime-switching purchasing power parity in Latin America: Monte Carlo unit root tests with dynamic conditional score. Applied Economics, 48 (29), 2675-2696.

Bahmani-Oskooee, M., & Nasir, A. (2015). Purchasing Power Parity and the Law of One Price: Evidence from Commodity Prices in Asian Countries. Global Economy Journal, 15 (2), 231-240.

Barisheff, N. (2013). $10,000 Gold : Why Gold’s Inevitable Rise Is the Investor’s Safe Haven. New York: John Wiley.

Baumol, W. J., & Blinder, A. S. (2009). Macroeconomics : principles and policy. Mason, OH: South-Western Cengage Learning.

Borsic, D., Baharumshah, A. Z., & Bekő, J. (2012). Are we getting closer to purchasing power parity in Central and Eastern European economies? Applied Economics Letters, 19 (1), 87-91.

Carbaugh, R. J. (2009). International economics. Mason, Ohio: South-Western Cengage Learning.

Crowther, D., & Capaldi, N. (2008). The Ashgate research companion to corporate social responsibility. Aldershot, England ; Burlington, VT: Ashgate.

Damodaran, A. (2007). Strategic Risk Taking: A Framework for Risk Management. New York: Pearson Prentice Hall.

Evans, M. D. (2011). Exchange-rate dynamics. Princeton: Princeton University Press.

Gogas, P., Papadimitriou, T., & Sarantitis, G. (2013). Testing purchasing power parity in a DFA rolling Hurst framework: the case of 23 OECD countries. Applied Financial Economics, 23 (17), 1399-1406.

Jiang, C., Bahmani-Oskooee, M., & Chang, T. (2015). Revisiting Purchasing Power Parity in OECD. Applied Economics, 47 (40), 4323-4334.

Korap, H. L., & Aslan, Ö. (2010). Re-examination of the long-run purchasing power parity: further evidence from Turkey. Applied Economics, 42 (27), 3559-3564.

Mankiw, G. (2015). Principles of Macroeconomics. New York: Cengage Learning.

Midway Corporation. (2016). Midway Corporation. Retrieved from Midwaycorporation.net: http://www.midwaycorporation.net/index.htm

Moody, R. (2005). The risks we run : mining, communities and political risk insurance. Utrecht: International Books.

Piersanti, G. (2012). The macroeconomic theory of exchange rate crises. Oxford: Oxford University Press.

Reid, M. (2014). Brazil : the troubled rise of a global power. New Haven: Yale University Press.

Sarno, L., & Taylor, M. R. (2002). Purchasing Power Parity and the Real Exchange Rate. IMF Staff Papers 49 (1), 65-105.

World Magazine. (2009). Gold Stocks VS Gold Bullion – Which is the Best Investment for You? Resource World Magazine 7 (3), 1-44.

X-RATES. (2015). US Dollar per 1 Japanese Yen – Monthly Average. Retrieved from X-Rates.com: http://www.x-rates.com/average/?from=JPY&to=USD&amount=1&year=2015

Young Wook, H. (2010). The Effects of US Macroeconomic Surprises on the Intraday Movements of Foreign Exchange Rates: Cases of USD-EUR and USD-JPY Exchange Rates. International Economic Journal, 24 (3), 375-396.

Zhang, Z., & Zou, X. (2014). Different measures in testing absolute purchasing power parity. Applied Economics Letters, 21 (12), 828-831.