MN6003 Strategy: Choices and Change: Browns Sports Footwear Case Study

Individual Strategy Assignment Briefing

(20% of module mark)

Your Individual Strategy assignment (e-portfolio 2) is a case study analysis of 1150 to 1500 words. You must analyse the Browns Sports Footwear case (case study is on weblearn and is 4 pages long) by applying appropriate strategy models from the core module text book, ‘Exploring Strategy’ (e.g. PESTEL, Five Forces, Strategic Grouping, Value Chain or Seven S, Porter’s generic strategies or Bowman’s strategy clock). You must summarise the strategic position of Browns Sports Footwear using SWOT analysis and then make recommendations for the future direction of the company using your analysis and the Ansoff matrix.

You should use tables or diagrams when you apply strategy models and populate them with data from the case. However, it is not sufficient to just apply models and produce diagrams or tables; you must discuss the key findings from each model (there are lots of marks available for the quality of your discussion). The information in tables or diagrams or in the end reference section will not be included in the word count. Your report should use full sentences and not bullet points (except in diagrams or tables).

You should reference your work using the Harvard system and use relevant academic reading to develop and support your work (at least three different academic sources). You do not need to read beyond the case for information about Browns Sports Footwear or the sports footwear industry. You should stick to the case and limit your reading to strategy text books and academic journal articles. You do not need to describe the models in detail e.g. you don’t need to explain what Porter means by ‘buyer power’; it will be clear from your analysis that you understand this.

Report structure

Introduction: Brief introduction to the assignment (50 to 100 words)

Main body: Models, e.g. PESTEL, Five Forces, Strategic Grouping, McKinsey Seven S or Value Chain, Porter’s generic strategies or Bowman’s strategy clock and SWOT, populated with your analysis from the case. Discussion (synthesis & key insights) after applying each of the models. This should end with a discussion of your SWOT analysis. (1000 to 1350 word plus diagrams or tables)

Recommendations: Recommendations for future strategic direction based on discussion in the main body and insights from your Ansoff matrix (100 to 200 words plus Ansoff matrix)

Reference section: in Harvard format. Only cite sources that are included in your assignment. There must be at least 3 different academic sources including the core text book. These should be cited in the main body as in-text references and in your end reference list. Wikipedia and BusinessBalls.com are not academic sources.

Assessment Criteria: Individual Strategy assignment |

| Demonstrates understanding of a wide range of strategy models and ability to appropriately apply them using the information from the case study. |

| Demonstrates understanding of the case study organisation and depth of insight and synthesis from the analysis of each model and analysis of the overall strategic position (synthesis of SWOT analysis). |

| Recommendations are based on the earlier analysis and demonstrate good understanding of Ansoff and the case. |

| Good evidence of academic reading. Good use of Harvard referencing. |

| Report is well structured and presented; arguments are coherent, logical and persuasive. |

MN6003 Browns Sports Footwear Case

Once the top British name in rubber sole sport shoes, sneakers and trainers, today this 95-year- old family owned company is just one of many in a growing pool of competing brands. In UK market share, Browns Sports Footwear trails behind Nike and Adidas, as well as Converse and Vans. The person given the task of restoring the company to its former glory is Michael Gordan, an ex-brand manager from Pepsico with an impressive track record. However, he is a newcomer to the sector and has not worked in fashion, sports or footwear before. We met him at the newly refurbished flagship store on London’s Oxford Street, where he presented the latest phase of a new marketing campaign which aims to emulate the successful resurgence of other British heritage brands like Burberry and Dr Martens.

At the height of its success in the late 80’s, Browns Sports Footwear was the number one trainer brand worn by everyone from sports stars to Madonna and Princess Diana. The design worn by Prince William, for his first school sports day in 1987, sold out in five countries in three days. Unexceptional these days, but let’s not forget there was no social media, no online shopping, just television and magazine coverage. However, the brand was a victim of its own success, failing to see the need to invest in new technology or advertising when people were queuing up to buy its products. Instead founders, the Brown family, ploughed profits into a series of disastrous investments including the Sinclair C5 and DeLorean cars. By the turn of the century they were quickly losing ground to big names like Nike and Adidas. By 2010 Browns Sports Footwear was attacked from all sides. Supermarket own brands and branded products such as Dunlop and Lonsdale, sold through Sports Direct, took market share at the bottom end. At the top end, trainers hit the catwalks and designers such as Channel, Tom Ford and Céline began promoting sneakers for the first time at eye watering price points of around £600 a pair. Stars on the Hollywood red carpets accessorised tuxedos with high end sneakers. In the mid-market, designer and sports collaborations with names like Raf Simons, Pharrell Williams and Michael Jordan helped to fuel growth at Nike and Adidas. At the same time suppliers of predominantly canvas based sneakers such as Converse, Vans and Toms increased in popularity, as well as trainers from brands like New Balance, Puma, Onitsuka Tiger, Superga, Skechers, LaCoste and Fred Perry.

Whilst trainers have grown in popularity, part of this increase comes from online sales, an area where Browns Sports Footwear lags behind its rivals. Whilst other players have used online media to promote new ranges, and savvy customisation to enable customers to tailor their designs, Browns Sports Footwear offered a very limited range online. Their website was criticised for slow delivery, a clunky returns process and was frequently out of stock of popular sizes. Browns Sports Footwear design team was late to key trends, like retro- inspired trainers and skater styles. They failed to capitalise on growing areas of the market such as the womenswear sector where celebrity fitness fanatics like Rosie Huntington-Whitely are encouraging a growing number of women in their 20’s to exercise. Growth in ‘athleisure’ wear, with jeans being replaced by yoga pants, joggers and ‘trackies’, has also been linked to growing sales of sports footwear. Substitute casual footwear products such as Havaianas, Fit Flops, Crocs and Birkenstocks, for sunny days, or Dr Martens, Timberlands, Uggs and Kickers for cold, have lost ground in recent years to sports trainers and fashion sneakers. Trainers have also encroached on traditional formal footwear, not just on the catwalk, but in classrooms where the line between sports shoe and formal school shoe has become increasingly blurred.

Growing knowledge of the benefits of a healthy, active lifestyle are fuelling growth across the whole sportswear sector. This is supported by the UK Government through campaigns to promote sports and counter dramatic rises in obesity rates. Current legislation mandates sports as part of children’s education. Sports England, a non- government organisation (NGO), is charged with investing more than $1bn of national lottery and government funding, from 2012 to 2017, into initiatives to encourage community sports. However, there are still debates about whether the London 2012 Olympics has helped the sector. Post 2012, the participation rates in sports have fallen in all categories except athletics, cycling and gymnastics, with swimming recording the most significant decline.

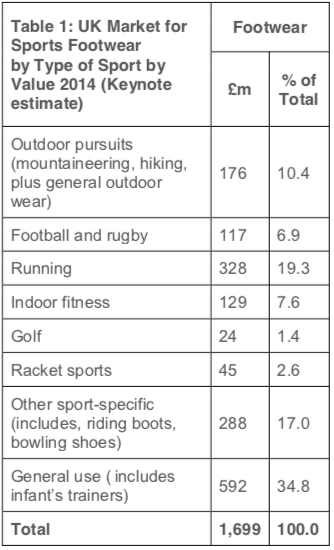

UK consumers are spending more on clothing and footwear as a % of total household expenditure. In 2010 clothing and footwear accounted for 5.4% of all household expenditure rising to 5.7% in 2014. Keynote estimates the UK sports footwear market has grown by 24% over 5 years, from £1.3bn in 2010 to £1.7bn in 2014. This reflects growth in functional performance sports footwear linked to health and fitness trends, as well as fashion trainers. Overall, the UK market is predicted to continue to grow over the next five years. Of the £1.7bn spent on sports footwear in 2014, an estimated 19% of the total (see table 1) was spent on running shoes and 35% on general use. When buying trainers, the typical amount spent across all adult age groups and across gender was £20 to £49, with only 0.1% of people spending £400 or more. People in lower social income groups were most likely to spend less than £20. Keynote estimates that in the last 12 months, 49.7% of UK

adults aged 25-34 bought trainers. This was the highest purchase rate in any age category, reflecting active lifestyles and relatively high disposable income. In all age groups, from age 15 to 54, over 40% of adults surveyed had bought trainers in the last 12 months. This declines to 30% for ages 55 to 64, and only 16% of people over age 65 bought trainers in the last 12 months.

The trend towards wearable technology and the success of the Nike Fuelband has begun to impact the footwear market with Nike MAG self-tying laces due for launch in 2015. Ethical concerns, particularly concerns about low wages and conditions in overseas manufacture, are also driving sales of ethical products, including non- leather based products and products manufactured in home countries. UK manufacture is seen as a sign of ethical production and quality by customers in the UK and overseas. Most sports shoes are still made from leather and suede and in the last five years, based on the availability of raw cattle hides, global leather costs have risen dramatically. This is due to both demand and supply effects with fashion and other markets using suede and leather extensively. There has also been a decline in cattle populations in the key supply countries, such as India and the US.

Globally, trends around the world are broadly similar to the UK, with Nike the dominant global player. The top markets for sportswear are the US, China, Japan, Brazil and Europe. In emerging markets, the most noticeable is Indonesia which has seen growth in football participation but also in gym memberships. This is associated with rising disposable income and a growing enthusiasm for a healthy and active lifestyle.

In a seemingly attractive and growing market, strong decline seems counter-intuitive and would challenge any new CEO. However, Gordan is bringing a passion for marketing, as well as a focus on operating efficiency, and the promise of new strategic direction to a company that has clearly lost its way. He has started by cutting costs, particularly at the over-staffed and bureaucratic head office. Gordan is still relying on the classic B logo that adorns the side of trainers (like the Nike swoosh, Adidas three stripes and New Balance N) and the famous gum soles with their union jack imprint. However, he is hoping to turn the company’s fortunes around and re-establish them as a top British brand.

The strategy draws on the heritage of the brand and a current global fondness for all things quintessentially British. “Young people are starting to look back at the 80’s in the same way our generation look back at the sixties,” Gordan says, with a genuine sense of surprise. “Our second hand 80’s models are selling for higher prices on ebay than our new stock.” Gordan doesn’t want to raise prices significantly, “there is good growth in the mid-market and our average selling price of £57 is already above many of our rivals.” The market is also increasingly unisex. One of Gordan’s first moves was to introduce men’s shoes from UK size 5 (up from 6) as they are increasingly purchased by women, reflecting a fashion trend toward androgyny and unisex clothing. Despite the risk of being ‘stuck in the middle’ and outflanked by rivals on every side, he is sticking with the middle ground, maintaining a focus on the mainstream consumer but repositioning the brand as embodying a retro, British, 80’s heritage feel.

Listening to Gordan, it is clear he loves the brand. As a former brand head of another mainstream brand, Pepsico, Gordan was key in helping the company fight off the challenge from rival Coca- Cola. Now Browns Sports Footwear, a family-owned company, is hoping that Gordan can do the same for them. The company needs to recapture older people who bought their trainers in the 80’s and have now moved away, and attract a whole new generation who are currently queuing to buy rival products.

The challenge is huge and Gordan is reluctant to suggest he is winning yet. “We’re not there yet— but we are on our way,” he told British Vogue in an interview this summer. Now it’s October 2015 and Gordan is just as cautious talking about his plan, “I’m just getting started, I’m confident but it’s too early to call it a success.” The company is the oldest British sports shoe supplier. It was founded in 1920, in Northampton, by Jonathan Brown whose wife Maria was born in Boston, Massachusetts. They married in Boston and it was there that his wife purchased a pair of rubber soled tennis shoes for Jonathan. Delighted by their comfort and performance, he brought the product back to Northampton, a centre for shoe manufacture, determined to improve on the design and tailor the shoes for the tastes of English gentlemen and women. First promoted through the Wimbledon ‘All England Lawn Tennis and Croquet Club’ and sold in Selfridges, Harrods and a small store in Northampton, the shoes grew in popularity, reaching their peak in the 1980’s. So why the decline, we ask Gordan. “The company didn’t invest in its core product, it took its customers for granted, and some big investment mistakes were made. As a result, people just started to choose other products. Slowly at first, but there was an economic downturn in the early 90’s and everyone thought that was the reason for declining sales. By the time the company realised they had lost their way, it was too late. Early in 2002 the company closed many of its own stores, relying increasingly on third-party sellers.”

Ask executives what the company strengths are and everyone says the same. The products are well made, with good quality raw materials and still manufactured in the UK. They’re as British as Marmite and fish and chips. But people aren’t buying fish and chips or Marmite like they used to. People spend £400 just to get a brand of trainer they love, but they don’t love this brand. The brand

has the same problem as Marks and Spencer says Gordan. “We’re seen as old fashioned and outdated, we’re just not cool.” Today Browns Sports Footwear has a 4% slice of the UK sports footwear market, down from 30% in 1985. Globally, its share has fallen from 8% to 2%. The blame for the steady decline, say industry analysts, is complacency and arrogance. “If you look at any sportswear company, they are out there, checking out the trends and constantly looking for innovation and inspiration,” said one former manager. “At Browns Sports Footwear, people were very insular, a lot of people had been there a long time, so there was experience but very little in the way of new ideas, or even emulating the ideas of others. It’s potentially a fantastic British heritage brand, but they just got too complacent.”

Gordan was on vacation in China when he was first contacted by a recruitment consultancy about the role of CEO at Browns Sports Footwear. “It was amazing,” he says. “I bought my first pair when I was 15 and I loved them and wore them until the tread was gone. I want other people to feel the same love for the brand that I do.” On his arrival, Browns only had two of their own stores left, one on Oxford Street and the original Northampton store. Remaining sales were through third-party retailers such as Foot Locker and Schuh. However, costs were still high with a large head office in Northampton and smaller sales satellites in the US and China.

At a leadership meeting in May 2014, Gordan gathered the company’s top executives to communicate the need for radical change. His message was clear, he says, “we need to grow both our revenues and our profits, modestly at first but steadily, year after year. That’s what great companies do and that’s what we’re going to do.”

In his first few weeks at Browns, Gordan met with each of the top 40 employees. He asked, “what do you want me to change?” He was troubled by how poorly the company was doing but also that many executives did not seem to realise the scale of the problem, and few had any ideas about what to do next. There was a lack of creativity and innovation. Gordan responded by changing many of the top team. Within a year, over 20 of the 40 most senior employees were replaced.

New hires include a new CFO (Chief Financial Officer) who cut nearly 20% out of operating costs whilst still retaining manufacture in the UK, and the same high quality product. With a better cost

structure in place, Gordan was able to convince the Board to invest in IT infrastructure, particularly the company website. Gordan then began to focus on his key strength, brand building. He mentions companies like Burberry, Dr Martens and Converse that have gone through tough times but have been revived by drawing on their histories. For Browns that involves repositioning the company as the oldest British sports shoe manufacturer. A major marketing campaign titled, ‘As British as Browns’, is currently using celebrity endorsement, social media, and other mass media vehicles to entice customers back. At the moment, Gordan says, “we’re focusing on fashion.” “It’s incredibly difficult to compete with the likes of Adidas and Nike when it comes to performance or technology because of their massive spend on research and development. But we’ll start by getting cool again and build from there.” Gordan hired Alicia Ennis, former brand manager of Keds, to become the head brand manager and to manage the refocus. She is travelling the world, overseeing the rollout of major displays in sports stores, and at pop up shopping mall events, highlighting the company’s history and British heritage.

A key aspect of the repositioning is the opening of new Browns stores, with five opening in the UK in 2015, and a modest programme of further rollouts scheduled for the US and globally in 2016 and 2017. The store layout, designed by Stella McCartney, is modern and welcoming. The design encompasses the brown of the famous B logo and the light beige of the gum coloured soles. The union jack, which is still imprinted on the trainer’s gum sole, is also imprinted on the wall panels.

There are some significant signs of early success. In 2015, revenues increased over the previous year by 10% whilst profitability was up 7%. More recently, the brand was featured in British Vogue. The association with Stella McCartney (a school friend of one of the Brown family) has proved fruitful, with Paul McCartney spotted wearing Browns. Alongside other recent celebrity sightings, including Alexa Chung, Jason Derulo and Carey Mulligan, it suggests that Browns is developing a broad appeal, but it is still too early to say if Gordan’s early work will translate into longer term success.

Solution

Introduction

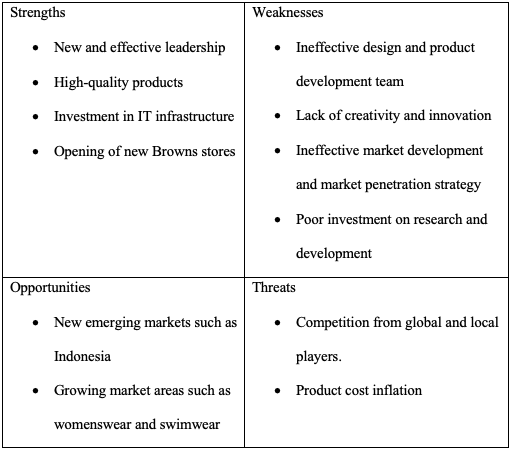

The sports footwear market is a profitable high-return market that has over the years attracted numerous firms. As the firms in the market compete for market share and dominance, they implement different corporate strategies. Companies such as Nike, Adidas, Converse, Vans, Browns and other players such as supermarkets continue to battle for market dominance. In the process, the effectiveness of their strategies determines their success and the achievement of their objectives. Following the competition, Browns has experienced reduced market share that can be attributed to different aspects. This case analysis integrates Porter’s Five Forces analysis framework, the SWOT analysis, and the Ansoff Product-Market Analysis Matrix to outline Browns sports footwear market share and develop recommendations for its increased competitiveness and organizational development.

Case Analysis

Browns’ market share in the UK and elsewhere has decreased significantly. The decline in the market share of the once dominant company can be attributed to different aspects that influenced its operations. For instance, the entry of new firms offering the same products in the market increased competition. According to Lynch (2015), any market that promises high returns experiences the threat of new entrants. The sports footwear industry was and remains a high-return yielding market and continually records new players. The emergence of new products as companies struggled to achieve a competitive advantage over the other competitors led to Browns’ diminishing market share. Additionally, the entry of different companies and new brands elevated competition significantly. For instance, supermarket-owned brands such as Lonsdale and Dunlop, which sold through efficient platforms such as the Sports Direct, acquired a large part of the market share. Moreover, the increased competition from other major players such as Nike, Adidas, Converse, and Vans led to the decreasing Browns’ market share. These companies applied different strategies to improve their competitiveness and increase their market shares.

The increasing competition in the market demanded the application of an effective market development strategy. As new entrants and the penetration of substitute products within the market required all companies within the market to apply efficient market development strategy to ensure continued market development and relevance (Grant & Jordan, 2015). The key players within the sports and footwear industry have constantly developed new products and enhanced existing ones to appeal to different market segments. For instance, substitute casual footwear products produced by different companies appealed to different market segments and affected Browns market share greatly. The development of fashion sneakers and sports trainers by the different competitors served as new entrants and substitutes for the existing products such as footwear designed for cold and sunny days. The different companies within the industry focus on the development of new and different products to maintain their customers and attract new ones to improve their market share. Browns has depicted little effort for market development and for the improvement of its market share.

As companies strive to improve their profitability and market share, effective market penetration remains central in the process. The UK sports and footwear market share is now dominated by companies that have constantly focused on the implementation of effective market penetration strategy. According to Grant (2015), market penetration strategy as a component of the Ansoff matrix demands the application of different strategies to increase the market share within the existing market segments. The strategy involves finding new customers and selling more of the company’s products to established customers. The increment of sales and the acquisition of new customers in the existing market segments depends majorly on the effectiveness of the promotion and distribution channels of the company (Porter, 2015). The diminishing market share of the Browns in the UK sports and footwear was because the company did not implement more effective promotion, distribution, and selling channels even as its competitors applied new technologies. For instance, as a market leader, the company did not invest in marketing and promotion or integrate new technologies into its operations.

Another key element of corporate strategy that enhances the competitiveness of a firm and boosts its sales and profitability is product development. An effective product development strategy is critical for the achievement of organizational success. It involves the creation of new products and their promotion and sale to existing markets in the quest to achieve market growth. As Johnson et al. (2013) assert, the process involves the extension of product range and the assurance of constant production, distribution and sale of the product where there is demand. The Browns sports footwear case reveals that after the acquisition of a significant market share and considerable dominance the company focused less on product development. Even with a larger pool of customers, the company was slow in its services and frequently ran out of stock of the popular sizes. Additionally, the company’s design team was late in the development of products such as key trends and the capitalization of growing market areas such as the sector of womenswear. As such, the ineffectiveness of the product development strategy contributed towards the reduction of the company’s sales and its decreased market share.

Moreover, the differentiation and diversification of products equip a company with a competitive advantage over its competitors. Following competitive rivalry, there was a need for Browns to focus on the development of an efficient diversification strategy (Johnson, et al., 2013). The strategy would involve the differentiation of its products to appeal to different market segments and allow for a continued increase in market share. The rising competition in the market, the differing quality production by competitors and the diverse products released in the market required any company competing for the market to distinguish itself from the rest. Browns should have invested in its design and product development team to develop new trends and differentiate its products. The process would have ensured the continued development of its market share.

Recommendations

Browns has different strengths, weaknesses and opportunities but also faces various threats. There is a need for the company to understand the existing opportunities, outline its strengths and work on its weaknesses to ensure continued success. As it focuses on the achievement of the above, the new leadership should focus on the establishment of an effective product development and design team. It should also adopt and implement effective market penetration and development strategies and boost its production efficiency. In all the processes, the company should enhance its production efficiency to reduce costs of production, product cost inflation and compete effectively with local and global market players. Of greater importance, however, the company should diversify its products and enter new emerging markets. The implementation of the various recommendations will guarantee the company considerable success in the sector.

Conclusion

The future of the BSF depends significantly on the strategies

it focuses on implementing. There is a need for the company to identify and

utilize its strengths in the development of its market share. Moreover, the

integration of its strengths and the investment in new technologies and marketing

would play a significant role towards its development. Additionally, the alleviation

of its weaknesses and focus on developing its production efficiencies, promotion,

distribution, and effective platforms for selling products are critical steps for

increased market share. It is also important for the company to focus on market

development and penetration and the diversification of its products to appeal

to different market segments and improve its market share. Most importantly, the

Browns should focus on product development and identify the weaknesses and

strengths of its competitors. The processes will ensure the company attains a

competitive advantage over its competitors and thus increased market share. This

will lead it towards its place as the top British name.

Bibliography

Grant, R. M., 2015. Contemporary strategy analysis. Hoboken: Wiley. https://www.wiley.com/en-us/Contemporary+Strategy+Analysis%3A+Text+and+Cases+Edition%2C+9th+Edition-p-9781119120841

Grant, R. M. & Jordan, J., 2015. Foundations of strategy. Chichester: Wiley. https://www.wiley.com/en-us/Foundations+of+Strategy%2C+2nd+Edition-p-9781118914700

Johnson, G. et al., 2013. Exploring strategy. Harlow, England: Pearson. https://www.google.com/books/edition/Exploring_Strategy/pX2ooAEACAAJ?hl=en

Lynch, R. L., 2015. Strategic management. Harlow, England: Pearson. https://www.google.com/books/edition/Strategic_Management/i71dDwAAQBAJ?hl=en&gbpv=0

Porter, M. E., 2015. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Simon and Schuster. https://www.google.com/books/edition/Competitive_Strategy/5xxHAAAAMAAJ?hl=en