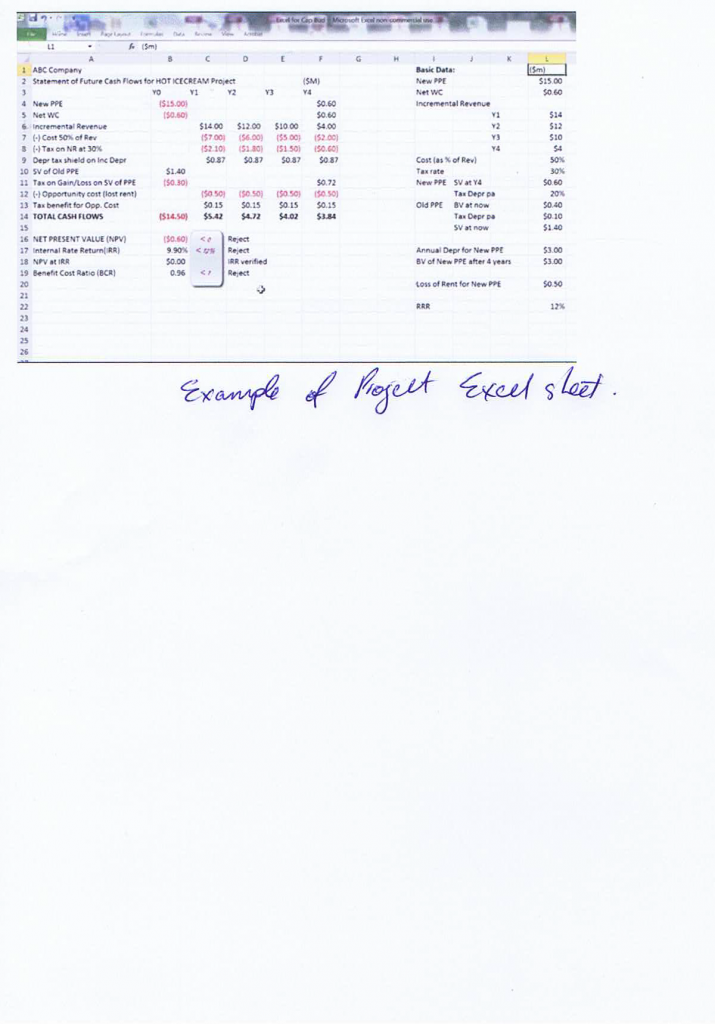

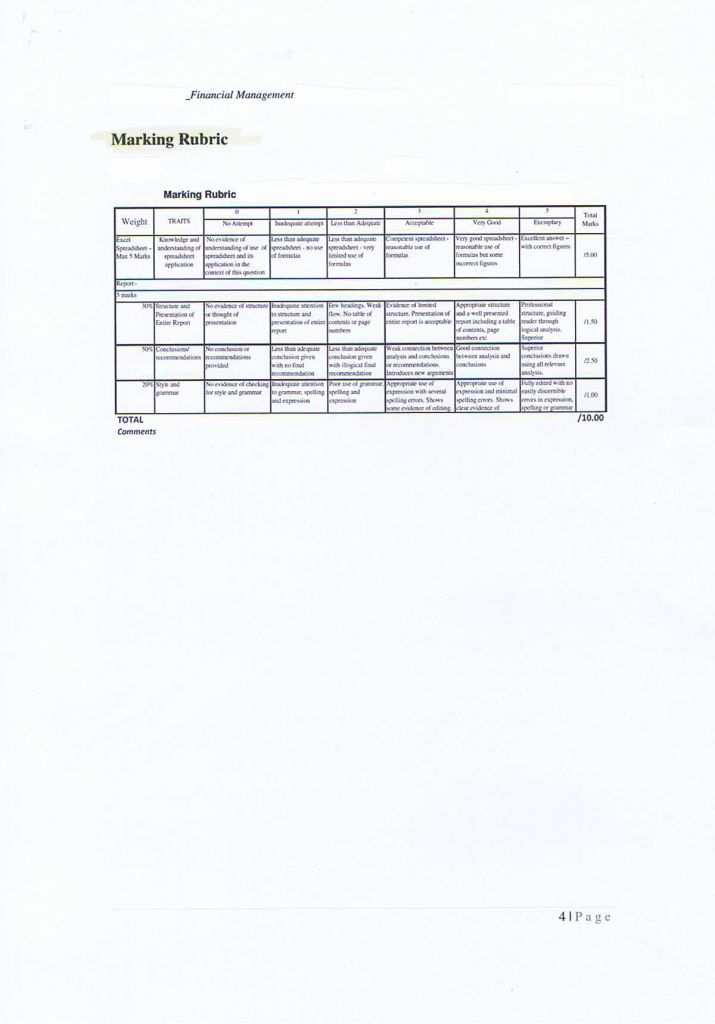

Capital budgeting analysis

The decision rule in net evaluations of business projects is to accept all projects with a positive net present value or those that have an expected rate of return greater than the rate of return on the capital market. (Richard A. DeFusco, 2010). Negative present values will necessitate losses and should be rejected as well as those with lower expected return. The evaluation of BESTHEALTH INC.s D-REM project gives a conclusion that the project should be dismissed. Different factors may discourage the overall cash flow evaluation. First, because the betas that determine the differing discount rates are not only measured with significant error but tend to drift substantially over the life of typical capital budgeting projects (Harold Bierman, 2012). There are different kinds of risks to be taken into account when considering Capital budgeting analysis, which should be seen in BESTHEALTH INC. Including:

- Market risks

This is the risk where the value of the investment will be influenced by changes in the market environment, which could have resulted in the negative present value, as any change in the market will eventually affect discounting rates (Kendrick, 2015). The fact that that the D-REM is not yet confirmed that it might cause physical side effects can also increase the market risk for the product over an extended period. The general manager must reconsider his intention of undertaking the project because the market risk is uncertain. The general manager must consider placing the project on hold until the credibility of the drug is approved and all side effects are eliminated, or its severity and frequency are reduced (Kendrick, 2015). BESTHEALTH INC should conduct further research about the D-REM drugBESTHEALTH INC on ways to improve the drug’s performance on the patients. This will reduce the possibility of the company incurring any market risk, which might affect the discounting rates.

- International risk (including currency risk)

This is the risk often caused by foreign exchanges and other import charges. In the case of BESTHEALTH INC., an import duty of $330000 was incurred which possibly could not have risen if the distributor was a local one and this could have reflected a better performance on evaluation. BESTHEALTH INC. Faces the risk of losing supplies from the local German dealer due to duty import risk. There might be an increase in import restrictions, which might make it, the expense for BESTHEALTH INC. to sell their products (H Bierman Jr, 2012). This will also increase the cost of production making the product expensive in the market. It is important for the general manager to consider the likely chance of the increase in restrictions, which might have a direct impact on the company’s financial performance. Currently, D-REM project already incurs high expenses on the import duty imposed on the supplies (Harold Bierman, 2012).

- Industry-Specific risk

BESTHEALTH INC. is operating under the health sector and just like any other sector; it poses its risks that must affect the potential performance of D-REM project. The area of health is a competitive industry where innovations and technology determine the competitive position of the firm in the industry. Companies are coming up with drugs that are more reliable and efficient in their functionality (Kendrick, 2015). This is going to pose a challenge for the D-REM project in gaining the trust amongst consumers if the D-REM drugs are proven potentially harmful to the patients. The other competitors in the health industry might take advantage of the weakness of BESTHEALTH INC because of the inefficiency of the D-REM drug to market their company or product in the market (Richard A. DeFusco, 2010). Therefore, to avoid any unnecessary inconveniences due to the unknown side effects of the drug, BESTHEALTH INC management needs to reject the D-REM project and reconsider other investments.

- Project- specific costs

BESTHEALTH INC’s project requires an annual quality assurance inspection that costs $48,000. This can be expensive for BESTHEALTH INC to maintain over an extended period. Such high-cost maintenance can be overwhelming on the company’s financial performance, especially when there is a high market risk for the project (Kendrick, 2015). This diminishes the ability of the project to survive over a long period in the market. D-REM project will also cost $200,000 on renovation alone, which includes installation cost of both new plant and equipment. BESTHEALTH INC will also require procuring human resources team, which will cost the company $64,000 at the beginning of the project. These costs increase the expenses for BESTHEALTH INC, which makes the project expensive to maintain over a long period. This will also reduce the possibility of the company benefiting from the project due to high expenses. It will take the business a long time before the general manager can recover the cost incurred during the operation of the project (Richard A. DeFusco, 2010). Therefore, the general manager must consider the high cost they are likely to commit if the projected is to be initiated.

Recommendation

Each of these risks addresses an area in which some sort of volatility could forcibly alter the plan of BESTHEALTH INC. managers. There are different ways to measure and prepare to deal with these risks as well (Kendrick, 2015). One such way is to conduct a sensitivity analysis. Sensitivity analysis is the study of how the uncertainty in the output of a model, that is, numerical or otherwise, can be apportioned to different sources of uncertainty in the model input (H Bierman Jr, 2012). From the rate of return calculation, it is evident that the provided rate was lower than the calculated rate evidence that the project should still be ignored.

BESTHEALTH INC. is likely to incur massive losses because of venturing in the project. This will be mainly contributed by the high expenses the company might incur if they choose to pursue the project. Also, BESTHEALTH INC.’s uncertain of the potential Side effects the drug might have on patient also reduces the possibility of the project taking effect on the market. People will be unable to trust the capability of the product in the market, which can affect the financial performance of the company (Richard A. DeFusco, 2010). Furthermore, BESTHEALTH INC will lose its reputation in the market, which can affect its competitive position in the health industry. BESTHEALTH INC. should focus on investing in projects that can help elevate the company’s financial status in the health industry. This is because the health industry is highly competitive and is transformed by the fast changing technological advancement (Kendrick, 2015). The general manager should consider the negative net present value of the project, which is less than zero indicating that the project is not viable for investment.

References

H Bierman Jr, S. S. (2012). Capital budgeting decision. london: taylor&francis group.

Harold Bierman, J. S. (2012). Capital budgeting. New York: ADventure works press.

Kendrick, P. T. (2015). Identifying and managing project risks. New York: Prentice Works Press.

Richard A. DeFusco, D. W. (2010). QUANTITATIVE INVESTMENT ANALYSIS. Boston: John Wiley & Sons.