Capital budgeting -case study

Instructions:-

Capital Budgeting Case – From the given case information, calculate the firm’s WACC then use the WACC to calculate NPV and evaluate IRR for proposed capital budgeting projects with a capital rationing constraint. After you choose the project(s), recalculate the capital structure based on the assumption that the project(s) are implemented and determine if the new capital structure will signal the investors either positively, negatively, or not at all. Write a business report on your findings. Include an executive summary and appendices if applicable. See rubric for specific graded criteria. Click on the attached document for additional information.

Solution

Capital budgeting -case study

Capital budgeting is one of the most important tasks of the finance function in an organization, due to the central role of capital investment in the success of an organization. This paper introduces the various investment appraisal methods including the traditional payback period, the discounted cash flow methods and the break even analysis and discusses their applicability in modern finance practice. A practical case is solved in different capital structure scenarios with the aim of selecting the most viable project that the company can invest in. Finally, the paper concludes with a discussion of the findings and implications of the decisions made and how they signal the market and investors.

Introduction

According to Higgins (1998) growth in a company is often premised on upon the investments that it makes. As they seek to maximize value for shareholders through growth and financial performance, companies must manage their inputs in a way that maximizes their output (returns), which calls upon the decision makers to carefully evaluate how best to invest business resources to reap maximum benefits, a source of competitive advantage, a term referred to as capital budgeting. It involves the listing of all the projects that a company wants to invest in and deciding on which ones to invest in to maximize its returns. Capital budgeting is, therefore, a critical component that informs a company’s resolve to stay competitive, sustainable, and viable as it helps in making pivotal decisions that optimize shareholder value and corporate resources in the longer run. There are various methods of assessing the viability of capital projects mostly through the comparison of cash inflows and outflows to quantify the net gains from undertaking the project. The most common include;

The payback period- This is a traditional investment evaluation method that calculates the time taken for an investor to recoup their initial investment. It assumes that the investor’s immediate financial requirement is to recover the investment within a reasonable period and therefore, the project that takes the shortest period to return the initial investment is selected.

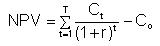

Net Present Value (NPV) – This is one of the most widely used methods of capital investment appraisal. It discounts the expected cash inflows using the cost of capital and compares the net inflows with the initial cash outflows to establish the net return on investment. A project would, therefore, be deemed fit for investment if the discounted cash inflows exceed the cash outflows, and in the event that all projects have positive net cash inflows, the one with the highest net inflows is selected, bearing in mind the associated investment risks.

The drawbacks associated with the use of the NPV relate to the assumptions and estimates made in making investment decisions, which leave a lot of room for errors. Some of the factors that must rely on estimates include the initial investments, projected inflows and the cost of capital since a project may require some unforeseen expenditures during takeoff and also at the end. The method does not also take into consideration the risks that are inherent in the projects and therefore fall into the usual trap of over projections. Despite these issues, Brealey and Myers (2003), presents an interesting rule that managers can in capital budgeting decisions: ‘ Invest in all positive net present value projects, and reject those with a negative net present value’’. They insist that by this rule, firms will ensure that all investment decisions maximize the value for shareholders. Since NPV is a complete measure of a project’s contribution to shareholders value, Brealey and Myers see no need to consider alternative investment appraisal tools.

The following formula is used to calculate the net present value;

where

Ct = net cash inflow during the period t

Co = total initial investment costs

r = discount rate, and

t = number of time periods

The internal rate of return (IRR) is another popular method of evaluating investment projects. It’s the discount rate at which the project’s net present value is zero. A project is deemed to be favorable if the internal rate of return is determined to exceed the company’s required rate of return. The formula for calculating the internal rate of return is similar to that of NPV, however, one would have to set the NPV at zero, and then calculate the discount rate which is the IRR. Since IRR calculation involves trial and error, computer programs such as excel can be used as shown later in this paper. In decision making, the higher the IRR, the more desirable it is to undertake the project.

While IRR is a popular project appraisal method, it’s often misleading if used in isolation, as there are incidences where the IRR is low while NPV is very high, depending on the initial investment costs, meaning that while the company may be seeing low returns, the value that the project adds is enormous. Additionally, IRR is not a reliable metric when evaluating projects with different life spans, with short duration projects having a very high IRR but much less NPV while longer term projects may have a low IRR but a high NPV at completion. Finally, as noted above, the IRR is not an easy method, as it relies on trial and error to compute and may, therefore, be difficult to non-finance professionals.

Breakeven analysis is a method that complements the above methods and is used particularly to test the sensitivity of various investment variables. The idea is to establish the level of sales that are required for the company to generate a net income.

Capital budgeting in practice

Karim et al (2010) in his research on capital budgeting in large firms in Canada noted that most firms tended to use the discounted cash flow techniques in their evaluation of investment opportunities. Thus DCF methods especially NPV and IRR are increasingly accepted in large firms in America and other parts of the world, with the usage of non-discounted cash flow techniques observed to decline in usage over the years. Cooper et al (2001) acknowledged that NPV and IRR are the most popular discounted cash flow method, although the payback period is still in use even in fortune 500 companies in corporate America, while Ryan & Ryan (2002) identified these methods as the most popular amongst the fortune 1000. Bevery & Boyd (2004) observed that at least 75% of local authorities in New Zealand used the NPV and the cost-benefit analysis in project appraisal. These sentiments were echoed by Truong et al (2006) who explained the widespread usage of the NPV and IRR as the most commonly utilized methods for capital budgeting in Australia.

Case study

In the section that follows, this paper analyses a capital budgeting case, given the various sources, capital structure a, costs of such capital and the initial costs of the two projects to choose from. The question required the calculation of the firms weighted average cost of capital (WACC), calculation of the Net Present Value (NPV) and evaluation of the firms Internal Rate of Return (IRR) for the projects and decision on which project to be undertaken. A further calculation of the capital structure will be done and a decision on whether the new capital structure signals the investors either positively, negatively or not at all. To calculate these metrics, excel formulas have been used as shown below.

Calculating the WACC

Since this company has three sources of capital i.e. Preferred stock, equity and long-term debt, each with its own cost, the WACC represents the companies average cost of its total capital, taking into consideration the costs and weights of each source of capital. Seeing that there is no tax element in the case study, the simple WACC would be calculated by multiplying the weight by the cost of capital as shown below;

| Particulars | Weights | Rate | WACC | |||||||||

| preferred stock | 25% | 19% | 4.75% | |||||||||

| long-term debt | 25% | 7% | 1.75% | |||||||||

| common stock and retained earnings | 50% | 20% | 10.00% | |||||||||

| WACC | 16.50% | |||||||||||

| Computation of the NPV and IRR | ||||||||||||

| Years | Project A | Project B | Discount | Project A | Project B | |||||||

| 0 | $ (130,000) | $ (85,000) | 1.000 | $(130,000) | $(85,000) | |||||||

| 1 | $ 25,000 | $ 40,000 | 0.858 | $ 21,459 | $ 34,335 | |||||||

| 2 | $ 35,000 | $ 35,000 | 0.737 | $ 25,788 | $ 25,788 | |||||||

| 3 | $ 45,000 | $ 30,000 | 0.632 | $ 28,460 | $ 18,973 | |||||||

| 4 | $ 50,000 | $ 10,000 | 0.543 | $ 27,144 | $ 5,429 | |||||||

| 5 | $ 55,000 | $ 5,000 | 0.466 | $ 25,629 | $ 2,330 | |||||||

| NPV | $ (1,520) | $ 1,855 | ||||||||||

| IRR | 16.06% | 17.75% | ||||||||||

| Statement Showing Calculation of WACC (New Capital Structure) | ||||||||||||

| Particulars | Cost | Proportion | WACC | |||||||||

| common stock and RE | 20% | 60% | 12.00% | |||||||||

| long term debt | 7% | 20% | 1.40% | |||||||||

| preferred stock | 19% | 20% | 3.80% | |||||||||

| New WACC | 17.20% | |||||||||||

| Computation of the NPV and IRR | ||||||||||||

| Years | Project A | Project B | Discount | Project A | Project B | |||||||

| 0 | $ (130,000) | $ (85,000) | 1.000 | $(130,000) | $(85,000) | |||||||

| 1 | $ 25,000 | $ 40,000 | 0.853 | $ 21,331 | $ 34,130 | |||||||

| 2 | $ 35,000 | $ 35,000 | 0.728 | $ 25,481 | $ 25,481 | |||||||

| 3 | $ 45,000 | $ 30,000 | 0.621 | $ 27,953 | $ 18,635 | |||||||

| 4 | $ 50,000 | $ 10,000 | 0.530 | $ 26,501 | $ 5,300 | |||||||

| 5 | $ 55,000 | $ 5,000 | 0.452 | $ 24,873 | $ 2,261 | |||||||

| NPV | $ (3,861) | $ 807 | ||||||||||

| IRR | 16.06% | 17.75% | ||||||||||

Analysis of findings and conclusions

Using the calculated WACC, we use Microsoft Excel to calculate the NPV and IRR of both projects. The results indicate that project A has an NPV of ($1,520) while project B returns an NPV of $1,855. This means that while project A appears to generate quite large cash inflows, when we consider the cost of capital over the period, we yield negative net present value, meaning that the project will lead to reduced value for shareholders at the end of the period. Project B, on the other hand, results in a positive net present value of $1,855 over the same period. It’s therefore recommended that project B should be selected between the two since it results in maximization of shareholders wealth. Project A has an IRR of 16.06%, which is lower, that project B of 17.75%. As discussed previously, the higher the IRR, the more attractive is the project for investment as it leads to higher returns on the capital invested, which maximizes shareholders wealth. Using IRR, therefore, project B will be selected while project A must be rejected.

Under the new capital structure (weights), where equity capital represents 60% of the total capital with both long-term debt and preferred stocks accounting for 20% each, the new WACC is 17.20% which is higher than the initial one. With a higher cost of capital, the computation of both NPV and IRR results in lower NPV for both projects. While the initial NPV for project B was $ 1,855, the new NPV given the new capital structure is only $807, revealing the impact of the increased cost of capital due to the amended capital structure.

Signaling

The theory of signaling dates back to the 70’s, where economists developed the capital structure signaling theory that was based upon the asymmetrical information that exists between management of an organization and investors. Models of signaling are therefore based on the idea that in most cases, the management of an organization has inner information, which if it was let out to the market, would affect the company’s stock prices. Since the management cannot just announce that inside information to the public, they do so through sending of signals. For instance, the management can change the capital structure in order to transfer some information relating to the profitability or risks involved in the firm’s decisions. According to Ross (1977), the choice of capital structure signals external users. The quality of firms that are able to raise debt finance tends to be better than those firms that operate mainly on equity. Therefore, there is a negative reaction to stock prices on companies that announce the issue of stocks in the market. Issuing of debt is a positive signal that the company expects to generate significant future resources to be able to offset these debts.

From the discussion above, it follows, then that the change in capital structure in our case sends a negative signal to the market. The increased use of equity (60%, previous 50%), is an indicator that the company is not doing well, and is, therefore, unable to raise the required debt financing. This is corroborated by the evaluation of the projects above, where increased use of equity financing has increased the WACC, and therefore, reduced the NPV of the selected project, as compared to the initial capital structure which had resulted to a reduced WACC.

References

Ross A. Stephen (1977). “The determination of financial structure: The incentive -signaling approach”, The Bell Journal of Economics, vol. 8 (1), pp. 23-40

Cooper, Morgan, Redman and Smith (2001), Capital budgeting models: Theory Vs Practice, Business Forum, Vol.26, pp 15-19.

Brealey, R., and Myers, S. (2003). Principles of Corporate Finance, (10th ed), New York: McGraw-Hill/Irwin, pp 102-104.

Lord Beverley R. and Boyd Jenifer R.(2004), Capital Budgeting in New Zealand Local Authorities: An Examination of Practice, The Journal of Contemporary Issues in Business and Government 11(1): 17-32.

Truong G., Partington G., & Peat M. (2006), Cost of Capital Estimation and Capital Budgeting Practice in Australia, University of Sydney, pp 7-13

Ryan Patricia A. & Ryan Glenn P. (2002), Capital Budgeting Practices of the Fortune 1000: How Have Things Changed?, Journal of Business and Management, Vol.8, pp 355-364.