HEDGING ASSESSMENT BRIEF/ TASK

The detailed requirements for this task are as follows:

| NZD/CHF = New Zealand Dollar / Swiss Franc. For your assigned currency paring you will be tasked with examining its performance over the period of 1st October to 1st November 2015. Based upon your examination of its performance, you are now tasked with designing a hedging strategy using a derivative contract of your choice (you are only allowed a single class of derivative contract, for example you are allowed to use both a put and a call option but not a combination of options and futures). The design process should include a consideration of your selected hedging strategy against alternatives (i.e. the contracts that you have not used) and an indication for the selection of your contract of choice. You are required to critically evaluate the hedging strategy that you have used in relation to your assigned currency pair. Your critical evaluation should show extensive consideration for the current state of the FOREX markets and arguments should include both academic and practical support. |

The following information is important when:

- Preparing for your assessment

- Checking your work before you submit it

- Interpreting feedback on your work after marking.

Assessment Criteria

The module learning outcomes tested by this assessment task are indicated on page 1. The precise criteria against which your work will be marked is as follows:

- Content and theory

- Secondary research

- Critical analysis

- Academic writing

- Presentation and referencing

Performance descriptors

Performance descriptors indicate how marks will be arrived at against each of the above criteria. The descriptors indicate the likely characteristics of work that is marked within the percentage bands indicated.

NOTE: consideration for the current state of the market based upon the data

Indicate using both hedging theory and market data the selection of hedging method. What indicators are used to suggest the hedging strategy? Why these indicators? How are these indicators used?

Your comparison should include an examination of the benefits and potential drawbacks of the each hedging strategy and this will have tie into their established discussions above

Solution

Hedging Strategies in Foreign Exchange Transactions

The essence of hedging, as applied by traders in the foreign exchange market, is minimizing the extent of any possible loss to ensure continuous profitability in the trade (James, 2008). Ideally, it is only possible to achieve the above goal with the presence of a party that is in a position to cover the downside risk that is so prevalent in the foreign exchange market. There are many available hedging strategies that have been applied by various traders in the pursuit of achieving their loss minimization goals. For instance, there is pair hedging that is a loss minimization strategy through which traders applies by way of trading correlated trade instruments in various directions. In a broad perspective, however, the primary hedging strategies are three which feature currency forwards, currency options, and currency futures. The application of any of the above three hedging strategies depends on the various underlying conditions in the foreign exchange market (Rheinländer and Sexton, 2011).

Hedging with Forward Contracts

It is essential to bear understand that the reason behind hedging is coming up with a method that applies to the risk management in trade, at least to the extent that any occurrence of loss risks are bearable (Clark and Ghosh, 2004). The use of currency forwards features a lot in the field of international trade. Notably, the significant aspect that determines the success of international business dealings is the exchange rate. The rationale behind the above finds its basis in the fact that foreign currency fluctuations usually have very significant effects concerning the outcomes and decisions governing international trade (Lioui and Poncet, 2005). In light of the above, it is common to shelve many international business and trade dealings. Ideally, the strategy that have featured in the above shelving in the larger part of the history of international trade is currency forwards. Ideally, a forward currency hedging strategy, otherwise known as forward contracts apply superbly well in managing the exchange rate risk present in international trade transactions (Artus, 2003). In short, forward contracts exist as custom agreements between the parties dealing in foreign trade, whereby the parties agree to fix the exchange rate for a future transaction.

As it seems in from the surface, forward contracts easily manage to eliminate the exchange rate risk in international trade dealings (Van den Berg, 2010). However, it also features significant shortcomings. For instance, it is not always easy to find a party who is ready and willing to fix the future rate according to the wants of the other party – particularly in the respect to the duration and the amount required by the party seeking to engage in the forward contract. It is possible to enter into a forward contract agreement with a bank (Lessambo, 2013). In so doing, a business person dealing in intentional trade transfers the foreign exchange risk to the bank and leaves the responsibility to deal with it with the bank. Additionally, there are no regulatory bodies to oversee forward contract undertakings.

Hedging with Futures

The above is another alternative for hedging in foreign exchange. The notable shortcomings in the application of forward contracts, such as the difficulty in finding counterparties, are some of the reasons behind the existence of the futures market (Larcher and Leobacher, 2000). A futures market involves buyers and sellers. Mostly, the two parties make trade deals involving the sale of particular currencies in stipulated future dates, and at a given exchange rate that is priory agreed upon or fixed by both parties. The futures market resembles the forward contracts a lot but for the fact that it is much more liquid. In this case, liquid means that there is an organization in the trading of futures (Ullrich, 2009). That is, the futures market exists as an organized exchange market in the same way as the stock exchange. The future contracts are subject to standardization, and thus, their sale or purchase is open just like in the case of the stock exchange market.

One advantage of a futures contract comes from the fact that by making a reverse transaction, it is possible to remove the obligation in the transaction before the initial contract expires. While hedging with futures, an investor buys futures if the underlying risk comes with the appreciation of the trade value, and vice versa (Bragg, 2011). Other advantages include the liquidity and ability to trade futures in a centralized market. More so, futures provide good trading leverages. Additionally, futures exhibit convergence as their expiration dates approach: the spot price and the price of the futures coming close. Future contracts have disadvantages, though. The fact that they have a strict legal obligation means that they can at times be problematic. Additionally, the standardization aspect in the futures contract means that it is not possible to completely hedge against the risks since there is a limit. Finally, traders taking a position in the futures market must pay daily variation margins irrespective of the result of their trades (Glantz et al., 2013).

Hedging by Use of Currency Options

Ideally, a currency option is a contract where the parties – a seller and a buyer – give the buyer the right to buy or sell various currencies at particular exchange rates before or at particular dates from different sellers of the options (Graham, 2014). The buyer has the right but has no obligation. However, the seller has the obligation should the buyer exercise his or her rights as stipulated in the options agreement. There are two types of currency options – the call options and the put options. Essentially, a call option allows the buyer to exercise the right of buying while the put option allows the buyer to exercise the right to sell a particular currency at a specific exchange rate either before or at a given particular date (DeRosa, 2011).

In the pursuit of compensating the seller, currency options feature a price paid to the seller known as the premium (Hicks, 2000). It is as a result of receiving the premium from the buyer of the option that a seller has the obligation to honor the buyer should he or she exercise his or her right. Comparing options for both the futures and the forward contracts exhibits the advantages of the options (Knight and Satchell, 2007). For instance, options feature limited downside risks due to the possibility to use more and flexible strategies. More so, options have the tendency to provide more significant cash flows to the traders since they do not have feature daily or initial variation margins in their operations.

Using the Currency Forwarding Hedging Strategy in Trading NZD/CHF

In the case of hedging for a foreign exchange trade such as the one feature in this case of NZD/CHF, currency forwarding hedging stands out as the perfect hedge strategy. As expected, however, it features a significant price in its application.

As highlighted above, currency forwarding hedging is an excellent way to apply in foreign exchange especially when trading currency pairs such as the NZD/CHF. That is, currency forwarding hedging is the most suitable for protecting against adverse movements in the price of the Swiss Franc (CHF) about the price of the New Zealand Dollar (NZD), and vice versa. In the currency pair trading such as the one of the NZD/CHF, it is very tricky to project short-term, and at times, even the long-term, fluctuations in the exchange rates for the currency pairs and thus currency forwarding hedging comes in handy (Exchange Rates – UK, 2015).

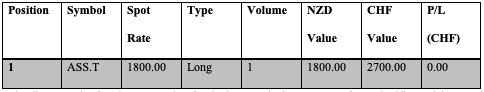

The basics of the currency forwarding hedging strategy are simple. Ideally, the whole idea is to mitigate the currency risk. Let us assume that an investor from New Zealand acquires an asset whose transaction and valuation denominations are in Swiss Francs (CHF). The illustration in the table below represents a possible account position for the above investor.

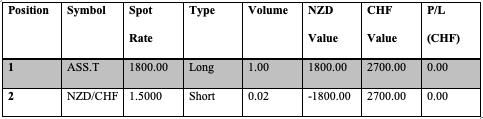

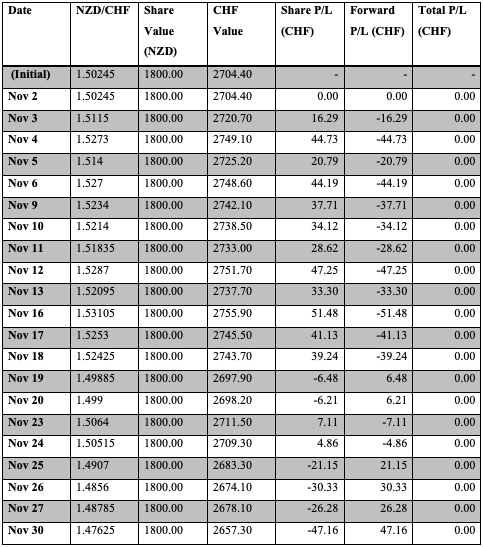

The direct result of such a transaction for the investor is the presence of two significant risks. To start with, there is a possibility of the share price of the purchased asset to fall – in the case of a long trade. Secondly, there is the possible risk of the Swiss Franc to fall against the New Zealand Dollar. Ideally, the nature of currency exchange is naturally volatile which means that the resulting movement in the exchange rate for the NZD/CHF currency pair could eliminate any potential profits in the above transaction in the long-run. In the light of the above, the currency forwarding hedging strategy applies in this case. Primarily, currency forwarding hedging, when applied in this case, involves the application of an NZD/CHF currency forward. The table below shows an illustration of the currency forward technique for offsetting the investor’s possible risk.

From the above illustration, it is clear that the investor “shorts” an NZD/CHF currency forward at the spot rate at the time of the transaction –that is, the current spot rate. Ideally, the volume of the transaction stands out in such a manner that its value (initial) equals the value of the share position. In so doing, the above strategy helps the investor to “lock in” the NZD/CHF exchange rate thereby providing protection against any volatility in the movement of the exchange rate between the NZD and the CHF in the – both in the short-run and in the long-run.

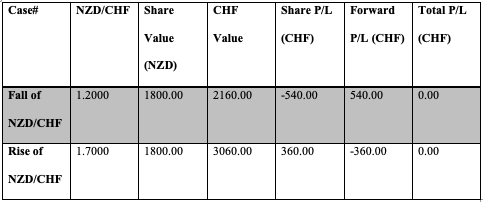

Notably, the value of the forward equals zero at the outset. Should the NZD/CHF fall, the result will be the rising of the value of the forward. A rise in the NZD/CHF leads to the fall in the value of the forward. The table below illustrates the occurrence of either the falling or the rising of the NZD/CHF.

Ideally, the domestic currency share price remains the same in both cases. In the first case where the NZD falls against the CHF, a lower exchange rate surfaces pushing the share price down to CHF 2160.00. However, the fall in the NZD/CHF means that the value of the currency forward increases to CHF 540.00 – which in short offsets the loss resulting from the exchange rate movement. On the other hand, a rise on the NZD/CHF pushes the share price up to CHF 3060.00 which is offset by a decrease of the currency forward by a value of CHF 360.00.

In light of the above, the table below shows the actual currency standings for the currency forwarding strategy for the investor in the entire month of November in the year 2015. The entry on November 1 (the first trading day in that month) applies as the initial share acquisition date for the investors asset, thus the spot rate on that day, that is 1.50245, stands out as the basis upon which the currency forwarding calculations are founded (Exchange Rates – UK, 2015).

Notably, though, the value of the NZD in the above example remained constant. Ideally, it is necessary for the investor to have a clear insight on the size of the forward contract before undertaking it. The rationale for the above finds its basis in the fact that the effectiveness of the above hedging strategy requires the investor to decrease or increase the size of the active currency forward to the right extent that matches the underlying value of the asset.

Conclusion

While using currency forwarding hedging, like every other foreign

exchange trade hedging strategies, requires the observation of two fundamental

aspects. The first aspect is the understanding and accepting the general truth

that hedging always comes at a cost. The second aspect is the understanding

that there is never a guarantee of perfect hedging (Abdel-Khalik, 2013). The above means that applying currency

forwarding hedging in the NZD/CHF or any other currency pair may provide a

significant peace of mind for a trader, but it always features a direct or an

indirect cost – both in the long-run as

well as in the short-run. More so, it is

vital for every trader, despite applying the currency forwarding hedging strategy,

to understand that the only way to surely avoid any loss while trading the

NZD/CHF currency pair is to avoid trading that pair in the first place.

List of References

Abdel-Khalik, A. (2013). Accounting for risk, hedging and complex contracts. Mason: Routledge.

Artus, P. (2003). Local Currency or Foreign Currency Debt?. Revue Economique, 54(5), p.1015.

Bodie & Kane & Marcus. ( 1999) . “Investments”.4th ed. Irwin / McGraw Hill

Bragg, S. (2011). The new CFO financial leadership manual. Hoboken, N.J.: Wiley.

Clark, E. and Ghosh, D. (2004). Arbitrage, hedging, and speculation. Westport, Conn.: Praeger.

DeRosa, D. (2011). Options on foreign exchange. Hoboken, N.J.: Wiley.

Exchange Rates – UK, (2015). New Zealand Dollar (NZD) to Swiss Franc (CHF) exchange rate history. [online] Exchange Rates (UK). Available at: http://www.exchangerates.org.uk/NZD-CHF-exchange-rate-history.html [Accessed 15 Jan. 2016].

Glantz, M., Kissell, R., Mun, J. and Paul, K. (2013). Multi-asset risk modeling. San Diego: Elsevier academic press.

Graham, A. (2014). Hedging Currency Exposure. Hoboken: Taylor and Francis.

Hicks, A. (2000). Managing currency risk using foreign exchange options. Cambridge, England: Woodhead Pub.

institute of international auditors UK and Ireland.University Edition.

Arnold, G . (2010) .“The financial times guide to investing” . 2nd ed. Financial times

James, T. (2008). Energy markets. Singapore: John Wiley & sons (Asia).

Knight, J. and Satchell, S. (2007). Forecasting volatility in the financial markets. Amsterdam: Butterworth-Heinemann.

Larcher, G. and Leobacher, G. (2000). An optimal strategy for hedging with short term futures contracts. Salzburg: Univ. Salzburg.

Lessambo, F. (2013). The international banking system. Houndmills, Basingstoke, Hampshire: Palgrave Macmillan.

Lioui, A. and Poncet, P. (2005). Dynamic asset allocation with forwards and futures. New York: Springer.

Prentice Hall Pearson.

Rheinländer, T. and Sexton, J. (2011). Hedging derivatives. New Jersey: World Scientific.

Stephens , J. (2003). “Managing currency risk : Using Financial derivatives”. The

Ullrich, C. (2009). Forecasting and hedging in the foreign exchange markets. Berlin: Springer-Verlag.

Van den Berg, H. (2010). International finance and open-economy macroeconomics. Singapore: World Scientific.

Wilmott , P. ( 2000 ). “Derivatives :The theory and Practice of Financial Engineering” .