Global Production Networks

| Analyse the Global Production Network (GPN) of your chosen product or service. Who benefits most from the structure of this GPN? Your analysis should include three main aspects: – What are the various forms of labour that go into creating the product or service, and how is this work globally distributed? – How is the value captured at each stage of production distributed along the network? – What are the institutional arrangements that explain the structure of this GPN? In consultation with your seminar tutor or module leader, you are free to choose any specific commodity or service that you want to research. When choosing, ensure that there is enough information available to enable you to write a good essay. Good examples for which there is a wealth of data available include coffee, smartphones and fashion garments. |

SAMSUNG MOBILE TECHNOLOGIES GLOBAL PRODUCTION NETWORKS

Introduction

The Global Production Networks (GPN) framework has been increasingly developed over the recent past, providing a new dimension through which managers can be able to understand the various important factors that drive the production process through the lens of the actor-network chain and the global value chain. The interconnected states that are involved in the transformation of inputs into outputs in any production process are hence critically analyzed through this model and a clear insight is drawn into the various aspects of the production system that are value creating and those that are non value adding. The Global Production Networks GPN of a given product includes all the resources input into the process and any other activities that are involved in creating value out of such resources. This paper is going to perform a Global Production Networks GPN analysis of the Samsung Mobile Technology value chain with the view of developing an understanding of the forms of labor involved in the production process, the distribution of value created, and the structural aspects of Samsung Electronic that contribute to the effectiveness of the value creation and distribution process.

Overview

Mobile media, on an overall scale, refers to the portability and mobility of media. As such, this involves the process through which content is created, the application of technology in this process, sharing of such media, distribution, creation and storage of digital media, and creation of new efficiencies and experiences innovatively. Mobile media thus addresses the desires and needs of the consumers to access and utilize media devises despite of their location across the globe. It is important to note that in such a convergent world, apart from people, devices also share data. Such a notion underlies the technology of the connected vehicle and the concept of ubiquity in Korea, Samsung’s country of origin, including the intelligent cities, houses, vehicles, people, and display devices.

The value chain

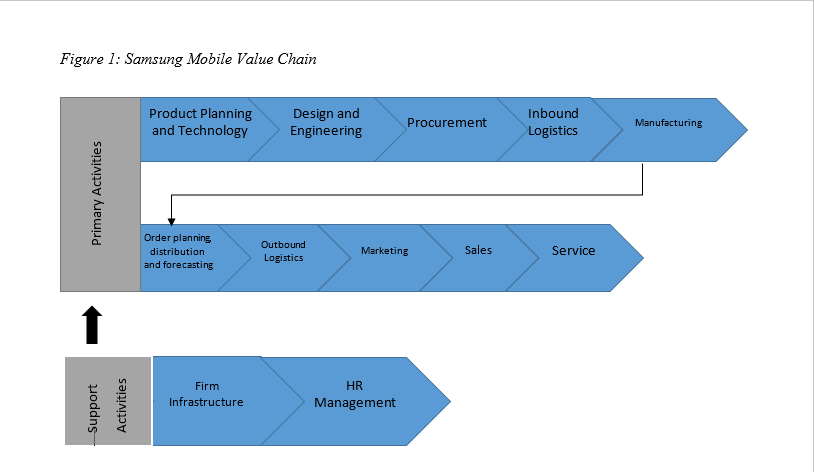

Samsung’s mobile media has experienced tremendous growth over the past few years, forming one of the fastest growing areas within the company, with the Galaxy smartphone leading the way. Although the company has faced various legal issues with Apple Inc., it has registered an increase in growth, an indication that if such issues that have a negative effect on the supply chain are put to rest, the company is bound to experience further growth. Back in 2010, Samsung sold a total of 280 million cell phones, which constituted a 20.2 percent market share (Grosse, 2016, p. 22). In the fourth quarter of 2011, there was a 30 percent increase in the Samsung smart phones’ shipments as compared to the third quarter of the same year. In 2011, Samsung mobile media and telecom’s total value was a high of KRW55.53 trillion (US$47.32 billion) with KRW8 trillion (US$ 6.8 billion) net profit prior taxation, and KRW8.27 trillion (US$ 7.05 billion) operating profit. As compared to the year 2010, this is an 89.6 percent increase in terms of the operating profit and a 38.5 percent increase in terms of sales (Grosse, 2016, p. 26). Most of the value in the production of the Samsung mobile phones is obtained from inside the organization or its affiliates, with the external sources contributing about a third of the resources and activities. The figure below presents a framework of Samsung’s value chain, showing the mobile media’s distinctiveness. There is the spatial dimension considering the fact that all the activities that involve the production of the Samsung mobile phones are not carried out in a single place, but are distributed across the world (Grosse, 2016, p. 25). Although most of the mobile technology activity is concentrated in Korea, it is also carried pout in Vietnam and China.

Unlike the original model of the value chain created by Porter which classified product development, research, and design as support activities, Samsung classified them as primary activities (Chang, 2008, p. 49). As such, product development and technology development are designated to the value chain’s first step, before inbound logistics and procurement. This approach to the value chain adds more value for the mobile technology considering the fact that Samsung has already established itself as a global leader in this area. Samsung has been established into a complex organization allowing it to create new products while also improving on the ones that already exist (Chang, 2008, p. 50).

Technology and product development

Samsung Electronics and its affiliates have increasingly invested towards maintaining the company’s leadership in media and mobile technology. To spearhead the company’s initiatives in this dimension is the Samsung Institute of Technology (SAIT), which is the center of R&D for the organization (OECD, 2009, p. 88). As such, any of the technology or product development processes involving Samsung mobile phones highly depends on whether such processes start within the R&D institute or the business division. SAIT’s mission is to establish Samsung mobile’s technological foundation that will allow the company not only to compete effectively with its core rivals but also to efficiently meet the needs of its consumers. Samsung works with various research communities across the globe, which engage in identifying the various challenges that are expected or arise within the mobile phone industry and use findings from such research to develop their products in such a way that allows them to overcome such challenges. The R&D institute has directed its research focus towards the changing landscape of IT (including the development of 4G networks, multicore, and intelligent web), New Device and Materials (including diverse areas such as Nano technology), Bio and health, and Environment and Energy (including areas such as water treatment, solar cells, and EV battery) (Michell, 2010, p. 73). It is the company’s R&D capacity that has allowed it to establish itself as a global giant in the mobile phone industry. R&D and design of Samsung mobile phones takes place in various centers across the globe, with the Korean Solution divisions preparing products both for internal Samsung customers and for external customers including Apple. The table below shows some of the centers from which Samsung Mobile Phones R&D is carried out.

| Name of Center | R&D Areas | Locations |

| Dallas Telecom Laboratory (DTL) | Products and technologies for telecommunications systems of the next generation. | US |

| Samsung Information Systems America Inc. (SISA) | Core technologies, components and strategic parts. | US |

| Samsung Electronic Research Institute (SERI) | Digital TV and Mobile phones software | Europe |

| Samsung Electronics India Software Operations (SISO) | Wired and wireless networks’ protocols, digital products’ system software, and handsets. | Asia-Pacific |

| Moscow Samsung Research Center (SRC) | Software algorithms, optics, and other emerging technologies | CIS |

| Samsung Telecom Research Israel (STRI) | Hebrew mobile phone software | Middle East |

| Samsung Semiconductor China R&D (SSCR) | Semiconductor solutions and packages | Asia-Pacific |

| Beijing Samsung Telecommunication (BST) | Mobile telecommunications commercialization and standardization for China. | Asia-Pacific |

| Samsung Electronic (China) R&D Center (SCRC) | MP3 players, Digital TVs, Software for China | Asia-Pacific |

| Samsung Poland R&D Center (SPRC) | EU STB/DTV commercialization, STB SW Platform Dev. | Europe |

| Samsung Yokohama Research Institute | Digital technologies, core next-generation components and parts | Asia-Pacific |

| Samsung India Software Center (SISC) | Graphic design, Application and Software Platform Design | Asia-Pacific |

Decision making Criteria for Sourcing

When it comes to mobile products sourcing at Samsung, unlike product development, Chinese based companies are preferred to other companies. Most of the mobile affiliates of the company, unlike semiconductors, are located in China. The preference for Chinese companies could be attributed to the low cost of labor in China, an aspect that allows the company to cut on its overall cost of production (OECD, 2009, p. 121). For companies to succeed as suppliers of Samsung Mobile technology, they are forced to work closely with the R&D institute as it is more difficult for a supplier to supply components of an existing product, which requires direct contact with the business divisions. At Samsung, the decision-making criterial applying to mobile suppliers does not vary greatly from one division to the next. As such, vendors are generally required to guarantee three conditions, which include: Value Added Engineering Activities; Competitive prices; and Excellent delivery dates and quality (Michell, 2010, p. 101).

Components

Samsung mobile phone components are sourced from their affiliates or existing Samsung plants. As such, external partners are only considered a source if the components are not available via the internal route (Grosse, 2016, p. 230). Both Vietnamese and Chinese plants have increasingly assessed local suppliers and approved some of them. Nevertheless, there is an increased push within the company to maintain sourcing in Korea only.

Assembly

Samsung Mobile phones are either assembled in Gumi in Korea, in the Vietnam based factory, or in different facilities located in China (Michell, 2010, p. 21). As earlier mentioned, the cost of labor has been a major drive behind the choosing of locations for Samsung mobile phones assembly factories. The assembly of mobile phones is highly labor intensive, an aspect that makes the cost of labor an important consideration. With increased push for a rise in the costs of labor in China, Samsung has increased its efforts in expanding the capacity of the Vietnamese factory.

Sales and Marketing

Samsung has more than 128 markets, each of which has its own sales and marketing company (Michell, 2010, p. 54). North America has several companies that market Samsung mobile phones. In the USA, all the sales partners are coordinated by Samsung USA, which also coordinates all marketing arrangements. The product divisions receive product ideas and design feedback from the mobile phones marketing companies. Normally, Samsung contracts the after-service to logistics partner, which also allows for the formation of part of the design and quality feedback loop.

Conclusion

It

is clear that Samsung Electronics has established a well-integrated system with

different parts coordinated towards the manufacturing of the mobile phones. The

company has expanded its internal infrastructure to allow for reduced outsourcing

of most of its activities in the production process. Samsung’s mobile phone

production has concentrated on low cost labor markets, with the view of cutting

on its production costs and increasing the profit margin. The R&D institute

and its partnership with other research experts across the globe forms the

pivot of the mobile production process as new product designs inform the

structural allocation of functions and approval of suppliers, inputs and

processing plants.

References

Chang, S.-J., 2008. Sony vs Samsung: The Inside Story of the Electronics Giants’ Battle For Global Supremacy. Singapore: John Wiley & Sons.

Grosse, R., 2016. Emerging Markets: Strategies for Competing in the Global Value Chain. London: KoganPage.

Michell, A., 2010. Samsung Electronics and the Struggle for Leadership of the Electronics Industry. Singapore: John Wiley & Sons (Asia) Pte. Ltd.

OECD, 2009. OECD Reviews of Innovation Policy OECD Reviews of Innovation Policy: Korea 2009. Paris: OECD.