prospect theory

Instructions:-

(7) Consider a bounded rational investor who makes decisions according to ‘prospect theory’.

a) Describe the bias of ‘loss aversion’. Use the loss aversion bias to illustrate the difference between rational behaviour and bounded rational behaviour.

b) Discuss the ‘value function’ in prospect theory. What is the role of the reference point? Compare the value function to the von Neumann Morgenstern utility index in expected utility. Use one or more diagrams to illustrate your answer.

c) Describe the utility function used in prospect theory and compare it with the utility function for expected utility. Discuss.

Suggested literature:

Mochrie, R. (2016), Intermediate Microeconomics, London: Section 27.3.

The essays submitted by different students must be distinct and are subject to considerations of collusion and/or plagiarism according to standard practice (do not leave yourself open to accusations of academic misconduct). This assignment represents 50% of each student’s overall mark for the module.

There is a maximum word limit of 1,000 words for each essay/question that will be strictly applied. The following rule will apply to any section exceeding its word limit (or not reporting an accurate word limit): its mark will be reduced by up to ten percentage points (depending upon the number of words over the limit). For example, an essay receiving a mark of 60% that exceeds the word limit can have its mark reduced to 50%. In particular, you will lose one percentage point for up to each 50 words over the limit. For example, an essay that is 1,150 words long will receive a 3 percentage point penalty while a report that is 1,151 words long will have its marked reduced by 4 percentage points. You are REQUIRED to provide a screen shot of the word count in your assignment (this will not include the bibliography or title page, however, all other written work for which you wish to receive marks should be included in the word count). This word count can be obtained using Word by pressing the following keys simultaneously Ctrl + Shift + G, when the word count is displayed press the Print Screen button to copy the screen and paste this onto a page towards the front of your essay). Assignments without word counts or with incorrect word counts may not receive a mark).

Solution

prospect theory

Describe the bias of ‘loss aversion’. Use the loss aversion bias to illustrate the difference between rational behaviour and bounded rational behaviour.

Loss aversion is a concept used in the prospect theory to indicate the behaviour of individuals regarding the making of decisions associated with economic factors. The prospect theory is an economic theory based on behaviour where it describes how people make their decisions regarding the selection between two or more possible alternatives likely to have a positive or negative impact. This means that people are expected to evaluate the alternatives and analyse their potential losses and gains before making their decisions. This behavioural economic theory is descriptive; that is, it strives to indicate how real-life decisions and choices are made in the economy where people tend to focus more on the possible losses and gains than the expected results or final outcome of a transaction (Mochrie 2016). Loss aversion, on the other hand, is a concept used in the behavioural economic theory where it indicates that when people are making decisions regarding some risky alternatives, they tend to avoid or minimise losses. This is because losing is viewed to have a greater negative impact on an individual compared to the satisfaction derived from a possible gain. The concept is considered a bias in the prospect theory since individuals tend to focus more on the negative side of the possible alternatives than the positive impacts. For instance, insurance is a good example which describes this bias effectively where people opt to take covers for their property to protect them from a possible loss despite the chances of the loss occurring being minimal. People find small losses being favourable than big losses; that is, in this case, insurance payments are better compared to a large expense in the event of a loss of the property. The bias of loss aversion can be used to indicate the difference between rational behaviour and bounded rational behaviour in the economy. Rational behaviour involves individuals making decisions regarding some choices where they are expected to provide maximum benefits in their final outcomes. This type of economic behaviour is not limited to any information since the people making the choices hope for the best when selecting the possible alternatives. Bounded rational behaviour, on the other hand, involves the decision-making process that is limited to information possessed by the people regarding the possible alternatives and the potential risks. The bias of loss aversion describes the bounded rational behaviour since the rationality of the people is limited by the potential losses associated with the choices made; hence, individuals opt to minimise losses than maximising gains.

Discuss the ‘value function’ in prospect theory. What is the role of the reference point? Compare the value function to the von Neumann Morgenstern utility index in expected utility. Use one or more diagrams to illustrate your answer.

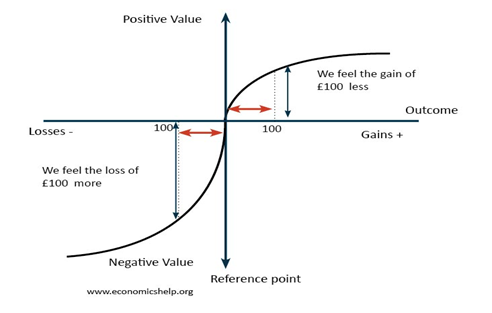

The prospect theory is used by Economists to compare the potential gains and losses that may occur from some outcomes. The behaviour of people during the decision-making process is limited to the losses and gains; hence, the value function indicates the correlation between the two factors. The value function used in prospect theory indicates the level of loss or gain expected from a specific outcome where it enables the decision maker to make the appropriate choice regarding the possible alternatives. The function is an asymmetrical and S-shaped curve that cuts through the reference point to identify the level of gains and losses of the final outcomes of the possible alternatives. The value function is asymmetrical; that is, it is an unevenly distributed curve where it is steeper for losses when compared to the gains; hence, in the prospect theory, losses are considered to outweigh gains. The reference point, on the other hand, is used to indicate the values of the losses and gains; that is, whether the outcomes reflect a positive or negative value.

Diagram One: Prospect Theory (Pettinger 2017)

The value function, in this case, indicates that the decisions made in the prospect theory rely on the information regarding losses. This means that people tend to focus more on the negative factors than the positive factors; hence, experiencing bounded rationality behaviour. For instance, the diagram indicates the value function being steeper for losses than gains since losses have a greater effect on the outcomes than gains; hence, people striving to minimize the losses. The Von Neumann Morgenstern utility index, on the other hand, is different from the value function since the rational behaviour of individuals is not limited by any information. In this case, the decision-makers make choices that are expected to maximize the gains from the possible alternatives. Therefore, the gains outweigh the losses in the Von Neumann Morgenstern utility index.

Describe the utility function used in prospect theory and compare it with the utility function for expected utility. Discuss.

The utility function used in prospect theory describes how people analyse losses and gains differently. The decisions made under this theory are based on the perceived gains and losses expected from the final outcomes. The utility function in prospect theory indicates that the losses outweigh gains since they have a greater emotional impact; hence, influencing the decisions made by individuals. The utility, in this case, can be viewed as either pain or joy where it is measured according to the level of gains or losses (Pettinger 2017). The feeling of pain created by a loss, in this case, is greater compared to the amount of joy created by a gain. For instance, the level of sadness due to the loss of money or property is greater compared to the level of happiness generated due to the gaining of money. The utility function for expected utility, on the other hand, is a normally continuous function where individuals make decisions that strive to maximize utility. The rational behaviour of the people, in this case, is not limited; hence, focusing more on the choices that result in maximum gains from the outcomes. Therefore, the utility function aims at ensuring the level of joy caused by gains is greater than the level of pain caused by losses.

References

Mochrie, R. (2016). Intermediate Microeconomics, Palgrave.

Pettinger, T. (2017). Prospect Theory | Economics Help. [online]

Economicshelp.org. Available at: http://www.economicshelp.org/blog/glossary/prospect-theory/