Smith & Wesson Holding Corporation: A Supply and Demand Analysis

Instructions:-

Supply and Demand Conditions

There are two rubric elements to be included in this section, and combined they should be about two pages in length, perhaps longer if you present more than one graph/table. The first element asks you to evaluate the trends in demand over time and explain their impact on the industry and on the firm. To do this, you can consider market demand. Market demand is the demand by all the consumers of a given good or service. Find out who your customers are, and provide detail on them. Use annual sales data to find out how much of the product is purchased. Here is a video explaining each of the following determinants of market demand that you could examine for your company’s market:

• Income

• Price of related goods

• Tastes

• Population and demographics

• Expected future prices

The second rubric element to be included in this section is your analysis of information and data related to the demand and supply for your firm’s product(s) to support your recommendation for the firm’s actions. You have already presented the overall trends in demand in the last element. In this rubric element, you will first collect data specific to your company on demand. To do this, look at the following:

• Sales and revenue. Building on the idea of market demand, consider how the annual sales data changed over time for your company in particular.

• Include a graph/table/chart of sales for your company. This may be in dollars, product quantity, or number of customers—whichever is most relevant for your firm. You could use more than one if you think that would give a more detailed picture of demand for your company’s product or service.

• Include 5 or more years of data, which will be enough to show a trend that is supported by your market demand discussion.

• Data can be found in the company’s annual reports, and revenue can more specifically be found in the company’s income statement.

One you have analyzed the demand side, you can now look at the supply side of your company. For this, you will want to watch this video on the determinants of supply, just as we examined the determinants of demand in the last rubric element. Some of the pieces you could explore and provide data on are:

• Input costs

• Technological improvement

• Prices of substitutes

• Number of firms in the market

• Expected future prices

Price Elasticity of Demand

This section has three elements and should be one to two pages long. The first element asks that you analyze information and data to justify how the price elasticity of demand for your product is determined. Here, you will have to use pricing of your product, the trend in the price over time, and comparison to similar products to justify whether you find the price elasticity of demand to be elastic or inelastic. You may not be able to calculate a specific price elasticity of demand (video), depending on your company and the available information. However, looking at pricing data should help you justify whether demand is inelastic or elastic.

You will then take your justification one step further in the second rubric element and explain the factors that affect consumer responsiveness to price changes. You can learn more about these factors from this video on the determinants of price elasticity of demand. Explore the following determinants as they relate your company’s product(s):

• Availability of substitutes

• Passage of time

• Luxury or necessity

• Definition of the market

• Share of budget

The third and last element in this section asks you to assess how the price elasticity of demand impacts the firm’s pricing decisions. As you read in Chapter 6 in our textbook, there is a relationship between elasticity of demand and revenue. You can watch this video to review the relationship between price elasticity of demand and total revenue and explain how this relationship influences the company’s pricing decisions. For instance, if a company sells a product that has very elastic demand, meaning customers are very responsive to a price change, then increasing the price means that the total revenue will decrease. This could explain why, in such a situation, the company may decide to not raise prices, even if its costs are going up. This is just one example, so be sure to make your analysis relevant to your company’s specific situation.

Solution

Smith & Wesson Holding Corporation: A Supply and Demand Analysis

Abstract

Supply and demand

forces are imperative to the success of

the firm. As such, this paper transcends a discussion of the supply and demand conditions as well as price

elasticity of demand for Smith & Wesson Holding Corporation (SWHC). Smith

& Wesson Holding Corporation is a US-based manufacturing company for

firearms. Its headquarters is based in Springfield Massachusetts. Its products

revolve around pistols and revolvers. Recently, they have gained much

popularity in worldwide. Recently, the company has hit its stock in August 2, 2016.Arguably, the demand for guns in

the nation has also increased impeccably due to the unrest caused by terrorism

activities.

Smith & Wesson Holding Corporation: A Supply and Demand Analysis

Demand Conditions

First, in the analysis of the demand conditions at SWHC, we will consider the market demand conditions. As such, an analysis of the demand for guns over time will be presented in Table 1 below.

Table1. The table below shows the net sales report for SWHC from the year 2011 to the year 2016:

| Year | Net Sales [in dollars] |

| 2011 | $342,233 |

| 2012 | $411,997 |

| 2013 | $587, 514 |

| 2014 | $626,620 |

| 2015 | $551,862 |

Market Demand Discussion

The market demand trend for guns at SWHC has been increasing from 2011 to 2014 and dropped in the year 2015. A report suggests that FBI background checks proved that the demand for guns by the American populace had increased dramatically from the year 2011 to 2015. The reason behind the rise in demand for guns was initiated by the insecurity propagated by terrorist activities in the country(Fuscaldo, 2016). Alternatively, the net sales in the year 2015 had a major drop due to the company’s decision to reduce stocks.

Supply Conditions

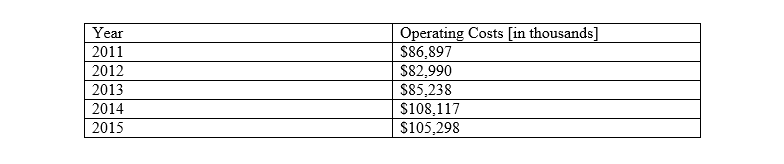

The input costs, as well as the prices of substitutes, are a critical feature that affects the supply conditions at SWHC. First, let us examine the input costs that the company dedicates to its firearms. The table below depicts the operating expenses of the company from the year 2011 to the year 2015.

Supply Conditions Discussion

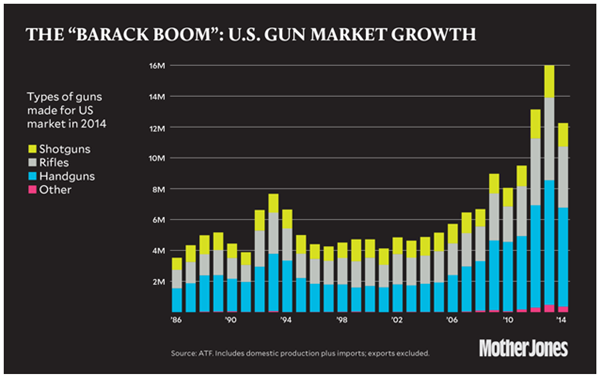

The operating costs for the firm for the year 2011-2013 averagely were $85041 while from the year 2014-2015 was $106707. Such a trend indicates that the company increased its costs so as to distribute more guns to its customers. Additionally, reports suggest that the prices of guns in the year 2014 skyrocketed in the country, and as such the company had to make a decision to increase the supply of its firearms. Alternatively, SWHC faces competition from companies such as Sturm Ruger, Remington Outdoor, and O.F. Mossberg and Sons breed competition to SWHC as they increased their supply of guns. The snapshot below shows how the supply of guns in the US increased drastically, conventionally termed as the “Barack Boom.”

Price Elasticity of Demand

Price Elasticity of demand replicates to the responsive change in demand of a product, in this case, the firearms to the change in the price of the product. It is noted that the demand for guns increased from $411,997 to $587, 514 in the year 2012 to 2013. Within this period, the prices of guns at SWHC, per se, a pistol (M&P®45 M2.0™ Thumb Safety) increased from $500 to $599 respectively. In calculating the price elasticity of demand;

E(p) = ∆D/D

∆P/P

E(p) = 171517/587514

99/599

E(p) = 1.81 (Elastic)

Consumer Responsiveness to Price Changes

A consumer psychological aspect that makes them respond to the products manufactured by SWHC is associated with the increasing quality of their product. Specifically, most customers responded to the price increase since the company started producing weapons that are light to carry and they had accuracy. These parameters are essential for any firearm.

Price Elasticity and Company’s Decision

The guns produced at SWHC have an elastic demand,

therefore, in the year 2015, the company

made the decision not to increase the

prices as they did in the year 2013 of which the consumers responded to the

price. As such, it defines the scenario where

the costs in 2015 rose, and the sales

decreased.

References

Fuscaldo, D. (2016, August 2). Smith & Wesson Reaches All-Time High On Gun Demand (SWHC). Retrieved January 24, 2017, from Investopedia: http://www.investopedia.com/news/smith-wesson-reaches-alltime-high-gun-demand-swhc/

Jinks, R. G., & Krein, S. C. (2006). Smith & Wesson. Arcadia Publishing.

Mücka, S. (2016). Price Elasticity of Demand and its effect on Revenue. GRIN Verlag Publishers.

SWHC. (2015). Smith and Wesson Annual Report 2015, 1.5. Retrieved January 24, 2017, from Annual Reports: http://www.annualreports.com/Company/smith-wesson-holding-corp